Get Ct-33-a Amended Return Employer Identification Number New York State Department Of Taxation And

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT-33-A Amended Return Employer Identification Number New York State Department Of Taxation And online

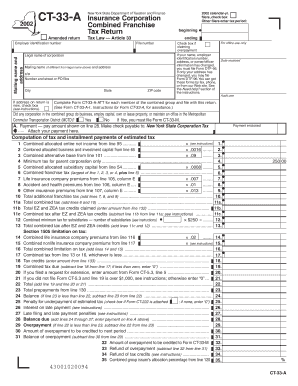

Filling out the CT-33-A Amended Return is essential for any corporation that needs to amend their tax return with the New York State Department of Taxation. This guide will walk you through the process step-by-step, ensuring you complete each section accurately, whether you are a first-time user or have experience with tax forms.

Follow the steps to successfully complete the CT-33-A Amended Return online.

- Click ‘Get Form’ button to access the CT-33-A Amended Return. This will allow you to download and open the form in an editor for further modifications.

- Fill in the legal name of the corporation and the mailing name and address in the specified fields. If these differ from the information previously filed, ensure to check the appropriate box.

- Enter the Employer Identification Number (EIN) accurately. This is crucial as it identifies your corporation for tax purposes.

- Indicate the tax period for which you are amending the return. If you are a calendar year filer, mark the box accordingly.

- Check the box if you are claiming an overpayment. If your name or address has changed, ensure to note this by indicating the changes in the appropriate section.

- Complete Form CT-33-A-ATT for each member of the combined group if applicable. This form provides necessary details for the entire group’s return.

- Proceed to the computation of tax and installment payments of estimated tax. Carefully calculate the amounts based on schedules provided in the form, ensuring all figures are accurate.

- Review the total combined tax and any tax credits claimed. Make sure to subtract these from your total tax to calculate the final amount due or refund.

- Sign and date the return after ensuring all information is correct. This verifies that you are responsible for the accuracy of the information provided.

- Finally, you can save the completed form, download a copy for your records, print it for mailing, or share it with authorized individuals as necessary.

Complete your CT-33-A Amended Return online today to ensure compliance and to manage your corporate tax filings effectively.

A taxpayer filing Form CT-3, CT-3-A, or CT-4 under Article 9-A, that does business, employs capital, owns or leases property, or maintains an office in the Metropolitan Commuter Transportation District (MCTD), must also file Form CT-3M/4M and pay a metropolitan transportation business tax surcharge on business done in ...

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.