Loading

Get Form Ct-33-a-i: 2002, Instructions For Forms Ct-33-a, Ct-33-a/att ... - Tax Ny

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Form CT-33-A-I: 2002, Instructions For Forms CT-33-A, CT-33-A/ATT ... - Tax Ny online

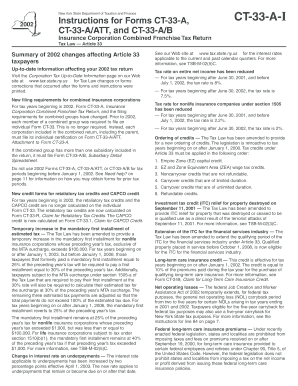

Filling out the Form CT-33-A-I is essential for insurance corporations filing their combined franchise tax return in New York. This guide provides clear, step-by-step instructions to help users navigate the form with ease, ensuring compliance with state tax regulations.

Follow the steps to accurately complete your tax form online.

- Press the ‘Get Form’ button to access the form and open it in your editor.

- Carefully read the introductory sections of the form to understand the necessary filing requirements for the 2002 tax year. Make sure you are aware of any recent changes that may affect your submission.

- Fill in your corporation's identifying information, including the employer identification number and file number, in the designated areas on the form.

- Complete the financial sections, including reported income, deductions, and tax credits, following the line-by-line instructions provided in the form. Make sure to attach any required schedules and additional forms, such as the CT-33-A/ATT, for each member of the combined group.

- If applicable, calculate the allocation percentages as required by Schedule A, and report total premiums as instructed in the respective schedules.

- Review all entries for accuracy and ensure that all supporting documents are attached before finalizing your return.

- Once all information is complete and verified, save your changes, and either download or print the completed form for submission.

- Mail your completed return to the appropriate address as indicated in the instructions, or consider using a private delivery service if you prefer.

Ensure compliance and file your documents online today!

A taxpayer filing Form CT-3, General Business Corporation Franchise Tax Return, or Form CT-3-A, General Business Corporation Combined Franchise Tax Return, under Article 9-A that does business, employs capital, owns or leases property, maintains an office, or derives receipts from activity, in the Metropolitan Commuter ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.