Loading

Get Form Ct-3-att: 2001 , Schedules B, C, D, And E - Attachment To ... - Tax Ny

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form CT-3-ATT: 2001 , Schedules B, C, D, And E - Attachment To Tax Ny online

This guide aims to assist users in effectively completing the Form CT-3-ATT: 2001, Schedules B, C, D, and E, which is essential for the General Business Corporation Franchise Tax Return in New York. By following these clear and detailed instructions, anyone can navigate the form with confidence, regardless of their prior experience.

Follow the steps to complete the form with ease.

- Click ‘Get Form’ button to access the form and open it in your preferred editing tool.

- Begin by entering your name and employer identification number at the top of the form.

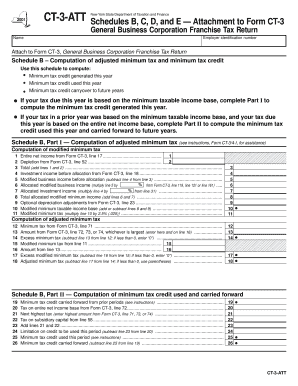

- Proceed to Schedule B, where you will calculate the adjusted minimum tax and minimum tax credit. Complete Part I if your tax is based on the minimum taxable income base.

- In Part I, list your entire net income from Form CT-3, line 17, and your depletion from line 52, then calculate the total.

- Calculate your modified minimum taxable income by following the instructions provided within the schedule.

- If applicable, move to Part II of Schedule B to compute minimum tax credit used this year and any carryover to future years.

- Next, fill out Schedule C, which requires calculating investment capital and determining the investment allocation percentage.

- For Schedule D, provide information on income from subsidiary capital, including interest, dividends, and capital gains.

- Complete Schedule E, focusing on adjustments for qualified public utilities and other entities as detailed in the instructions.

- After filling out all relevant sections, review your entries for accuracy before saving your changes. You can then download, print, or share the completed form as needed.

Ready to complete your Form CT-3-ATT online? Start now!

Form CT-3 General Business is typically needed by businesses that are subject to New York State corporate tax. This includes C-corporations, S-corporations, limited liability companies (LLCs) treated as corporations for tax purposes, and other entities that are required to file a New York State business tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.