Loading

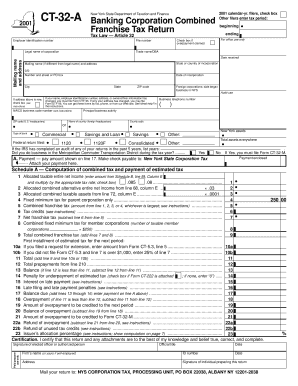

Get Filers, Check Box Other Filers Enter Tax Period: Beginning Ending For Office Use Only Date Received

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Filers, Check Box Other Filers Enter Tax Period: Beginning Ending For Office Use Only Date Received online

This guide provides clear instructions on filling out the Filers, Check Box Other Filers Enter Tax Period: Beginning Ending For Office Use Only Date Received form. Designed for users with diverse levels of familiarity, this guide aims to ensure accurate and effective completion of the form.

Follow the steps to accurately complete your tax form.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred document editor.

- Locate and check the appropriate box for 'Filers'. If you are filing under a different category, check the 'Other Filers' option.

- Enter your Employer Identification Number (EIN), which is a unique number assigned to your business by the IRS. Ensure this number is correct as it identifies your corporation.

- Fill in the 'Legal Name of Corporation' as it appears on your official documentation. This ensures consistency with your tax records.

- Input the 'Trade Name/DBA' if different from your legal name, as this will help clarify your business identity.

- In the 'Mailing Name and Address' section, provide your current mailing address. If it's different from the legal name, be sure to specify.

- Complete the 'For Office Use Only' section, including the 'Date Received' mentioned—this ensures proper tracking of your submission.

- Specify the 'Tax Period' by indicating the beginning and ending dates clearly, typically aligning with the business's fiscal year.

- If applicable, check the box for any overpayment claimed to ensure that any refundable amounts are processed.

- Review all sections for accuracy, ensuring that all required fields are filled out correctly before finalizing your form.

- Once completed, save the document and choose your preferred action — you can download, print, or share the form as needed.

Complete your tax documents online to ensure compliance and accuracy.

You can file the GST return online as follows. Step 1: Register for GSTIN. ... Step 2: Log in to the GST portal. ... Step 3: Returns dashboard. ... Step 4: Prepare online. ... Step 5: Enter details. ... Step 6: Check submission status. ... Step 7: Tax payment. ... Step 8: Offset liability.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.