Loading

Get For Office Use Only Attach Label, Or Print Or Type New York State Department Of Taxation And

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the For Office Use Only Attach Label, Or Print Or Type New York State Department Of Taxation And online

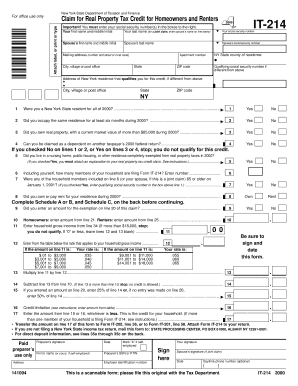

Filling out the For Office Use Only Attach Label, Or Print Or Type New York State Department of Taxation and Finance form is an essential step in claiming tax credits for homeowners and renters. This guide provides clear and detailed instructions to help you complete each section of the form accurately and efficiently.

Follow the steps to successfully fill out your form.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Begin with your personal information. Enter your first name and middle initial, last name, and social security number in the appropriate fields.

- If applicable, enter your spouse’s first name, middle initial, last name, and their social security number.

- Fill in your mailing address, including the number, street (or rural route), city, state, ZIP code, and apartment number if necessary.

- Indicate your county of residence in New York State and provide a qualifying social security number if it differs from what was previously entered.

- Answer the questions regarding your residency and property ownership status by marking 'Yes' or 'No' as appropriate.

- If required, complete Schedule A or B for homeowners or renters, respectively, detailing your tax payments or rent paid during the relevant year.

- Calculate your household gross income and enter this amount. If it exceeds the set threshold, you will not qualify for the credit.

- Follow the instructions for the calculations required based on your inputs and ensure you align with the rates applicable to your reported income.

- Finally, review the form for accuracy, sign and date where indicated, and if needed, gather any additional documentation required for submission.

- Save your changes, and be sure to download, print, or share the form as necessary for filing it with the New York State Department of Taxation.

Complete your documentation online to ensure you receive your tax credits efficiently.

State Only Return Requirements – New York returns can be transmitted with the Federal return or as a state-only return unlinked from the Federal return. Amended Returns - Amended returns are required to be e-filed. Form to use: Use Form IT-201-X if the original return was Form IT-201.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.