Loading

Get Form Ct-3-bi: 1998 , Instructions For Form Ct-3-bi, Ct3bi - Tax Ny

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form CT-3-BI: 1998, Instructions For Form CT-3-BI, CT3BI - Tax NY online

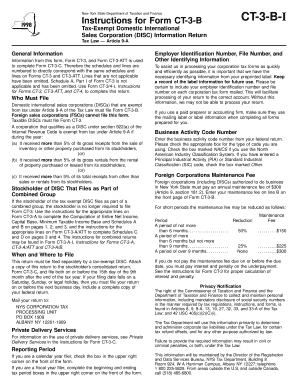

Filling out the Form CT-3-BI is essential for tax-exempt domestic international sales corporations in New York. This guide provides a structured approach to help you navigate the form and its requirements efficiently.

Follow the steps to complete your Form CT-3-BI online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Review the general information section on the form to understand the context and purpose of Form CT-3-BI. Ensure that your corporation qualifies as a tax-exempt domestic international sales corporation (DISC) under Article 9-A of the Tax Law.

- Indicate who must file by confirming your status as a DISC exempt from tax. If your corporation does not qualify, you will need to file Form CT-3 instead.

- If applicable, provide the stockholder information for any DISC that files as part of a combined group. Refer to Form CT-3-A instructions for further details.

- Complete the filing section, which includes indicating when and where to file your return. Make sure to attach a copy of the return to the stockholder’s consolidated return, Form CT-3-C.

- Fill out the reporting period section. If you are a calendar year filer, check the appropriate box. For fiscal year filers, complete the beginning and ending tax period boxes.

- Enter the employer identification number, file number, and any other identifying information as requested. This information is crucial for efficient processing of your return.

- Provide the business activity code number from your federal return and check the corresponding box for the type of classification you are using.

- If applicable, calculate and enter the foreign corporations maintenance fee on line B of the form, noting the reductions available for shorter periods.

- Review all entries for accuracy, ensuring compliance with tax regulations. Save your progress, download, or print a copy of your completed form for your records before submission.

Prepare and complete your Form CT-3-BI online for efficient processing of your tax-exempt return.

S Corporations doing business in New York must file their franchise taxes using a form CT-3-S. This can be used to submit an initial, amended or final return. The document is found on the website of the New York State Department of Taxation and Finance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.