Get New York State Department Of Taxation And Finance Instructions For Form Ct-186-e Telecommunications

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the New York State Department Of Taxation And Finance Instructions For Form CT-186-E Telecommunications online

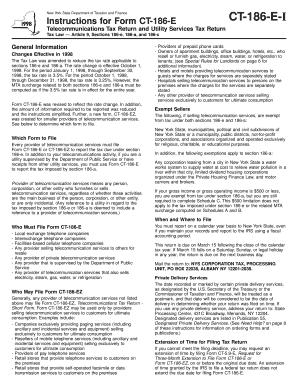

This guide provides clear instructions for users on how to complete the New York State Department Of Taxation And Finance Instructions For Form CT-186-E Telecommunications online. Whether you are a provider of telecommunication services or a utility entity, this guide will support you throughout the process of filling out the form correctly.

Follow the steps to fill out Form CT-186-E online efficiently.

- Click the ‘Get Form’ button to access the form in your online editor.

- Identify the appropriate form to use based on your type of telecommunication services. Determine if you should file Form CT-186-E or the simplified Form CT-186-EZ.

- Fill in the top section including your company name, employer identification number, and contact information.

- Complete the Business Activity Code Number from your federal return, checking the appropriate box for NAICS or other classification.

- If applicable, mark the box for ‘Amended Return’ if you are submitting any changes.

- Review the specific instructions for the relevant schedules (A, B, C, D) that apply to your operations and fill them out as needed.

- Enter your gross charges for telecommunication services, following the guidelines for allocating charges, including intrastate, interstate, and ancillary services.

- Complete Schedules A, B, C, or D that apply to you. Ensure to check totals accurately.

- Calculate the taxes and any applicable surcharges by following provided formulas and examples within the guide.

- Review all sections to ensure all necessary information is filled out correctly, and no fields are left blank that require answers.

- Once completed, save your changes, and if needed, download and print the form for your records.

- Share the form or submit it as required to the appropriate mailing address.

Start filling out your Form CT-186-E online today to ensure compliance with New York State tax regulations.

-- Claim for credit or refund of an overpayment of income tax shall be filed by the taxpayer within (i) three years from the time the return was filed, (ii) two years from the time the tax was paid, or (iii) in the case of any overpayment arising from an erroneous denial by the department of environmental conservation ...

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.