Loading

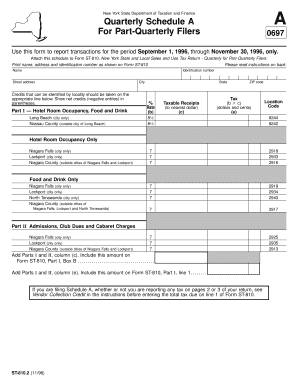

Get New York State Department Of Taxation And Finance Quarterly Schedule A For Part-quarterly Filers A

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the New York State Department Of Taxation And Finance Quarterly Schedule A For Part-Quarterly Filers A online

This guide provides step-by-step instructions on filling out the Quarterly Schedule A for Part-Quarterly Filers A from the New York State Department of Taxation and Finance. Designed to assist all users, regardless of prior experience, these instructions will lead you through the process of completing the form online.

Follow the steps to successfully complete your Quarterly Schedule A online.

- Press the ‘Get Form’ button to access the form and display it in your preferred editor.

- Begin by entering your name, identification number, and street address as shown on Form ST-810. Ensure that this information is accurate to avoid processing delays.

- In Part I, report hotel room occupancy and food and drink taxable receipts based on the locality of sales. For each category (Long Beach, Nassau County, etc.), input the taxable receipts into the respective columns.

- Calculate the tax due by multiplying the taxable receipts entered in column (c) by the applicable tax rate in column (b). Enter the resulting amount in column (e) for each line.

- In Part II, report any admissions, club dues, and cabaret charges similarly. Ensure you separate the entries according to the respective localities as per the guidelines provided.

- After completing both parts, sum the totals from column (c) and column (e). Ensure these figures are included in the relevant boxes on Form ST-810.

- If applicable, calculate your vendor collection credit as specified in the instructions. This may affect the total tax due.

- Once all sections of the form are completed, you may save your changes, download the document, print it for your records, or share it as necessary.

Complete your Quarterly Schedule A online today for a streamlined filing experience.

The difference occurs due to the fact Federal and state governments have different tax brackets. While you may not qualify for Federal taxes, you may still qualify for state taxes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.