Loading

Get New York State Department Of Taxation And Finance New York State Resident Credit Against Separate

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the New York State Department Of Taxation And Finance New York State Resident Credit Against Separate online

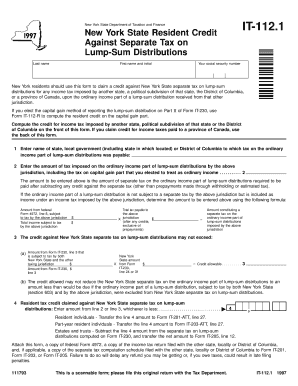

Filling out the New York State Resident Credit Against Separate Tax on Lump-Sum Distributions form is essential for users looking to claim a credit for taxes imposed by other jurisdictions. This guide provides clear, step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to successfully complete the resident credit form.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Enter your last name, first name, and initial, as well as your social security number in the appropriate fields.

- Identify the jurisdiction where the tax was imposed. Enter the name of the state, local government, or the District of Columbia, in the designated area.

- Input the amount of tax imposed on the ordinary income part of the lump-sum distributions in the specified field, ensuring that it reflects the correct calculation as described in the form’s instructions.

- Calculate the maximum allowable credit. Follow the provided instructions to determine the applicable amounts from Form IT-230 and ensure that the credit does not reduce your New York State separate tax below the required amount.

- Claim the resident tax credit against the New York State separate tax by entering the lesser amount from the line 2 or line 3 fields as required.

- If applicable, for resident individuals, transfer the credit amount to Form IT-201-ATT, line 27; for part-year residents, transfer to Form IT-203-ATT, line 27.

- Attach the completed form along with the necessary documentation, including copies of federal Form 4972 and any tax returns filed with the other jurisdiction, ensuring all requirements are met to avoid delays or penalties.

- After reviewing all completed fields for accuracy, save the changes, and proceed to download, print, or share the form as needed.

Complete your tax documentation online today to ensure a smooth filing process.

Related links form

The New York City School Tax credit is available to New York City residents or part-year residents who cannot be claimed as a dependent on another taxpayer's federal income tax return. The credit amounts vary. This credit must be claimed directly on the New York State personal income tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.