Loading

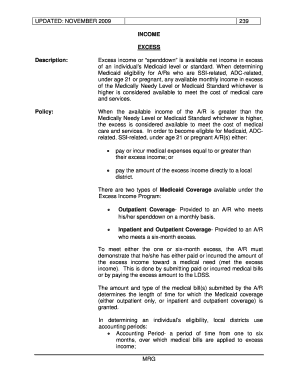

Get Excess Income Or Spenddown Is Available Net Income In Excess

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Excess Income Or Spenddown Is Available Net Income In Excess online

Filling out the Excess Income Or Spenddown Is Available Net Income In Excess form is an essential step for individuals seeking Medicaid coverage under specific income constraints. This guide aims to provide a comprehensive overview of the form, ensuring that all users, regardless of their legal experience, can navigate it successfully.

Follow the steps to fill out the form accurately.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Provide personal information in the designated fields, including your name, address, and date of birth. Ensure that all details are accurate and match your official documents.

- Indicate your income sources by filling out the income section. Include all monthly sources of income you receive, ensuring to list them in the specified format.

- Calculate your excess income by subtracting the Medically Needy Level or Medicaid standard from your total income. Enter the excess amount in the relevant field of the form.

- Detail your incurred or paid medical expenses that are being used to meet your excess income requirement. Include all relevant treatments and services, and provide receipts or evidence where applicable.

- Review your completed form for accuracy. Double-check all entries, ensuring that there are no errors or omissions.

- Once satisfied with your entries, proceed to save the changes made to the form. You may also choose to download, print, or share the completed form as necessary.

Complete your documents online today to ensure your Medicaid eligibility.

Your spend-down amount will be the difference between your income and the Medicaid eligibility limit, as determined by your state over a given length of time (one to six months). Some states require you to submit receipts or bills to Medicaid to show your monthly expenses.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.