Get Ca Boe-502-d 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA BOE-502-D online

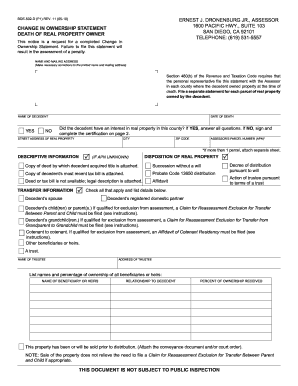

The CA BOE-502-D, or Change in Ownership Statement, is a vital form for reporting the ownership status of real property after the death of the property owner. This guide offers clear, step-by-step instructions to help users fill out this form accurately and efficiently online.

Follow the steps to complete the CA BOE-502-D online.

- Click the ‘Get Form’ button to obtain the form and access it in the editor.

- Begin filling in the name and mailing address section. Make any necessary corrections to ensure accuracy.

- State the name of the decedent and the date of death. Indicate whether the decedent had an interest in real property in the county by selecting 'Yes' or 'No.'

- If the answer to the previous question is 'Yes,' provide the street address, city, ZIP code, and Assessor's Parcel Number (APN) of the real property. If there is more than one parcel, attach an additional sheet.

- In the descriptive information section, indicate the disposition of the real property. Check the appropriate boxes and attach any required documents, such as deeds or tax bills if applicable.

- Fill out the transfer information by checking all that apply regarding the decedent's relationship to beneficiaries or heirs.

- List the names and percentages of ownership of all beneficiaries or heirs. Include the name, relationship to the decedent, and percentage of ownership received.

- If applicable, address any sales of the property prior to distribution by attaching the relevant documents.

- Answer questions related to any lease agreements or shares of ownership in legal entities as prompted.

- Provide the mailing address for future property tax statements. Include the name, address, city, state, and ZIP code.

- Complete the certification section by providing the signature of the spouse, registered domestic partner, or personal representative. Ensure to include the printed name, title, date, email address, and daytime telephone number.

- After completing all sections, review the information provided for accuracy. You can now save changes, download, print, or share the completed form.

Start filling out the CA BOE-502-D online today to ensure compliance and avoid penalties.

The best way to transfer a property title between family members is to use a gift deed, which allows you to convey property without requiring payment. Ensure the deed is properly filled out and filed with your local county recorder’s office after being signed and notarized. This method is tax-efficient and can be easily processed using the templates available on platforms like US Legal Forms, helping you navigate the necessary documentation.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.