Loading

Get Schedule O. Schedule O-part I, Ii And Iii With Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Schedule O. Schedule O-Part I, II And III With Instructions online

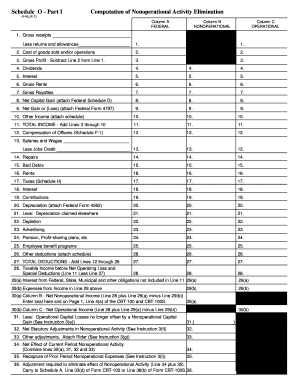

Completing the Schedule O is an essential part of the Corporation Business Tax Return (Form CBT-100 or CBT-100S) for any corporation wishing to report nonoperational activities. This guide provides a comprehensive overview and step-by-step instructions to help users proficiently complete each part of the form online.

Follow the steps to complete the Schedule O sections online:

- Click the ‘Get Form’ button to access the Schedule O and open it in your online document editor.

- Begin with Part I, where you'll need to enter your corporation's gross receipts, returns, allowances, and cost of goods sold in the respective columns. Carefully subtract to calculate gross profit, and record dividends, interest, rents, and royalties as instructed.

- In Part II, declare any nonoperational assets your corporation acquired or disposed of. Include a description, date acquired, and federal basis for each asset. Make sure to answer the questions regarding claims to other taxing jurisdictions and any associated liabilities.

- Move to Part III to compute tax due on nonoperational activities. List the gross receipts and costs associated with each activity in the corresponding columns, calculating total income and deductions accurately.

- As you fill out each part, refer to the provided instructions for guidance on specific fields or calculations necessary to comply with tax regulations.

- After completing all sections, review your entries for accuracy. Save changes, download, or print the form as needed before submission.

Start completing your Schedule O online to ensure accurate filing and compliance.

Form 5471 Schedule M reports transactions with the US taxpayer and an extensive group of entities reflected in the different columns therein: Any other domestic corporation or partnership the US person might control. Any other foreign corporation or partnership that the US person might control.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.