Loading

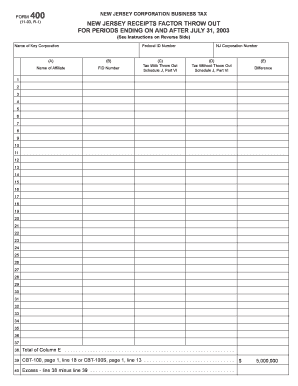

Get Form-400 - 2003. New Jersey Receipts Factors Throw Out For Periods Ending On And After July

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form-400 - 2003. New Jersey Receipts Factors Throw Out For Periods Ending On And After July online

Filling out the Form-400 - 2003 is essential for businesses in New Jersey to accurately report their receipts factors for tax purposes. This guide provides a detailed step-by-step approach to ensure you complete the form correctly, helping you navigate through the online requirements effortlessly.

Follow the steps to fill out the Form-400 - 2003 online

- To begin, use the ‘Get Form’ button to obtain the Form-400 - 2003 and open it in your preferred online editor.

- In Column A, enter the name of the affiliate as specified on their tax documents. Ensure the spelling is accurate to avoid any discrepancies.

- Proceed to Column B and fill in the federal identification number of the affiliate. Double-check for correctness, as this number is critical for identification purposes.

- In Column C, record the amount of tax reported on Schedule J, Part VI, line 7 from the affiliate’s return, labeled as Tax with Throw Out. This figure should accurately reflect the affiliate’s tax obligations.

- Next, fill out Column D with the tax reported on Schedule J, Part VI, line 21 from the affiliate’s return, identified as Tax without Throw Out. Ensure that this figure is also taken directly from the affiliate’s documentation.

- For Column E, calculate and enter the difference between the amounts recorded in Column C and Column D. This calculation is essential for determining the tax implications.

- Once all columns are accurately filled out, you may review the form for any errors or omissions. Make necessary adjustments to ensure completeness.

- Finally, you can save your changes, download the completed form, print it if needed, or share it as required.

Complete your Form-400 - 2003 online today to ensure compliance with New Jersey tax regulations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.