Loading

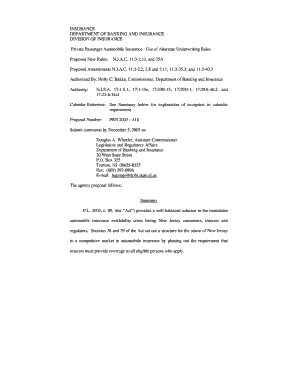

Get Use Of Alternate Underwriting Rules - Nj

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Use Of Alternate Underwriting Rules - Nj online

Filling out the Use Of Alternate Underwriting Rules - Nj form is an essential process for insurers looking to implement alternative underwriting criteria in New Jersey. This guide provides clear, step-by-step instructions for successfully completing the online form, ensuring adherence to state regulations.

Follow the steps to effectively complete your form online.

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

- Begin by reviewing the scope and purpose section. It outlines the applicability of the rules, ensuring you understand which areas of insurance they impact.

- Proceed to fill out the definitions section, confirming that you understand the key terms used throughout the form, such as 'alternate underwriting rules' and 'qualified eligible person.'

- In the requirements section, specify if you are opting to use alternate underwriting rules and provide details of the territories where these will be applied. Make sure to document whether you are meeting the growth requirements.

- In the activation section, confirm your decision regarding the approval of alternate underwriting rules or indicate a request to cease writing business in certain territories. Include necessary growth data demonstrating compliance.

- Ensure to complete the certification statement, affirming that all information entered into the form is accurate and complies with state regulations.

- After reviewing all sections for accuracy, users can save changes, download, print, or share the completed form as needed.

Complete your documents online today to ensure compliance with New Jersey's alternative underwriting rules.

Underwriting, whether for an insurance policy or a loan, revaluates the riskiness of a proposed deal or agreement. For an insurer, the underwriter must determine the risk of a policyholder filing a claim that must be paid out before the policy has become profitable. For a lender, the risk is of default or non-payment.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.