Loading

Get Az Charitable Organization Registration/renewal 2010-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AZ Charitable Organization Registration/Renewal online

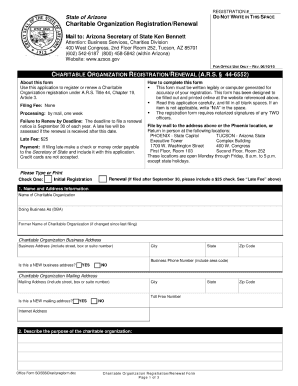

Filing the AZ Charitable Organization Registration/Renewal is an essential step for organizations seeking to operate charitably in Arizona. This guide provides a clear and supportive approach to completing the form online efficiently.

Follow the steps to complete your registration or renewal process.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with the organizational details section. Provide the legal name of your organization and its primary address. Ensure that the information is accurate to avoid any processing delays.

- In the next section, input the names and addresses of the principal officers of your organization. This information helps verify your leadership structure and represent your organization accurately.

- Complete the financial information section. Here, indicate your organization's fiscal year, revenue sources, and budget. Be as detailed as possible to assist in the assessment of your organization's financial health.

- Follow by providing information about your organization’s programs. Describe the charitable activities your organization conducts, how these benefit the community, and any additional relevant information that supports your mission.

- Finally, review all entries for accuracy and completeness. When you are satisfied with your entries, save changes, download, print, or share the completed form as needed.

Complete your AZ Charitable Organization Registration/Renewal online today.

Related links form

Arizona tax credits work by allowing taxpayers to reduce their tax liability based on specific contributions made to eligible causes or organizations. These credits can lead to significant savings on your state tax bill while supporting your community. Understanding how Arizona's tax credits function can encourage you to participate in AZ Charitable Organization Registration/Renewal effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.