Loading

Get Ar Dfa Ospv100 2017-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AR DFA OSPV100 online

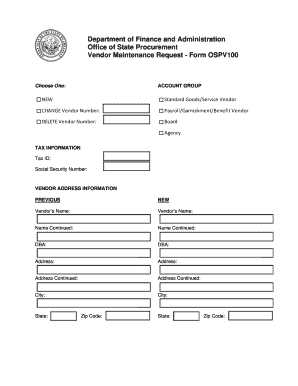

Filling out the AR DFA OSPV100 form online can simplify your vendor maintenance requests and ensure accurate processing. This guide will provide you with step-by-step instructions to navigate the form carefully, making the process as smooth as possible.

Follow the steps to successfully complete the AR DFA OSPV100 form online.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Choose the appropriate account group from the list: Standard Goods/Service Vendor, Payroll/Garnishment/Benefit Vendor, or select ‘Delete Vendor Number’ if necessary.

- Enter the tax information by providing either the Tax ID or the Social Security Number as required.

- Fill in the vendor address information including the vendor's name, DBA (Doing Business As) name, and the complete address details including city, state, and zip code.

- Input vendor contact information by providing the salesperson's name (optional), fax number, telephone number, and email address.

- If applicable, complete the direct deposit information. You may need to submit a copy of a voided check by indicating the bank name, account type, bank account number, and bank routing number.

- Indicate any minority indicators by selecting the appropriate options for the Arkansas Certified or Non-Certified Minority Indicator, if applicable, and provide the certification number.

- Select payment terms by choosing the appropriate options available in the form.

- If applicable, check the 1099 reportable section, including exemption codes.

- If the vendor is a licensed or certified work center, check the corresponding box.

- Provide partner information by outlining partner vendor numbers and associated addresses if applicable.

- Complete agency contact information by inputting the requester's name, email address, telephone number, purchasing organization number, and agency details.

- Once all sections are filled, review the information for accuracy before saving your changes. You may then choose to download, print, or share the completed form.

Complete your vendor maintenance requests online today!

Related links form

Arkansas estimated tax payments should be mailed to the address specified for estimated payments on the Arkansas DFA website. Ensuring you use the correct address helps avoid any delays or penalties with your estimated payments associated with AR DFA OSPV100. To assist you in this process, consider utilizing the resources on the uslegalforms platform.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.