Loading

Get Va Vec-fc-20 2000-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA VEC-FC-20 online

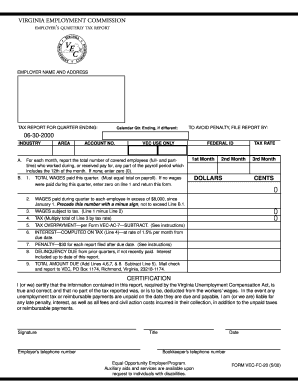

The VA VEC-FC-20 is an essential document for employers to report quarterly taxes to the Virginia Employment Commission. This guide will provide step-by-step instructions to help users accurately complete the form online, ensuring compliance and avoiding penalties.

Follow the steps to effectively fill out the VA VEC-FC-20 online.

- Click ‘Get Form’ button to obtain the form and access it for completion.

- Enter the employer's name and address at the top of the form to clearly identify the reporting entity.

- Indicate the tax report period by filling in the 'Tax report for quarter ending' field, specifying the exact date.

- If applicable, fill in the 'Calendar Qtr. Ending' field if it differs from the main reporting date.

- Complete the 'To avoid penalty, file report by' section with the due date of the report.

- Specify the industry in which the business operates to provide context for the reporting.

- Fill in the area and account number fields, ensuring all information matches official records.

- In section A, report the total number of covered employees for each month. If no employees worked, enter zero (0).

- In section B, enter the federal ID number and detail the total wages paid for each month of the quarter. If no wages were paid, indicate zero.

- Report any wages paid to each employee in excess of $8,000, using a minus sign if applicable.

- Calculate the wages subject to tax by subtracting Line 2 from Line 1. Enter this amount in the designated field.

- Multiply the total from Line 3 by the tax rate provided and fill in the tax amount.

- Complete the 'Tax overpayment' section if relevant, and ensure that all calculations for interest and penalties are included.

- Add the relevant totals to determine the 'Total amount due' and prepare to submit payment as indicated in the form.

- Finally, sign and date the certification section, providing the required contact information of the employer and bookkeeper.

- After completing all sections, save changes, download or print the form for your records, and submit it as instructed.

Complete your VA VEC-FC-20 online to ensure timely submission and compliance with Virginia employment tax regulations.

In Virginia, VEC refers to the Virginia Employment Commission, which is vital for managing unemployment benefits. Its functions include overseeing the unemployment tax collection process, such as with the VA VEC-FC-20 documentation. Engaging with VEC helps both employees and employers by fostering a more robust employment ecosystem.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.