Loading

Get Tx 05-139 2007

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX 05-139 online

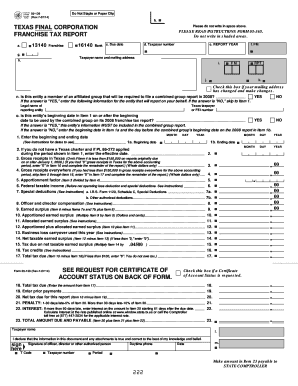

The TX 05-139 is the Texas Final Corporation Franchise Tax Report, essential for corporate taxation in Texas. This guide provides clear, step-by-step instructions to help users efficiently complete the form online.

Follow the steps to successfully complete the TX 05-139 online.

- Press the ‘Get Form’ button to access the TX 05-139 form and open it in your online editor.

- In section 'a', do not write in the shaded areas and provide the necessary details as instructed. Ensure you enter your taxpayer number in field 'd' and the reporting year in field 'e'.

- Enter your full taxpayer name and mailing address in the designated fields. If your mailing address has changed, check the relevant box and make the necessary updates.

- In section 'n', determine if your entity is part of an affiliated group that must file a combined report. If 'YES', provide the legal name and Texas taxpayer number of the reporting entity.

- In item '1', enter the beginning and ending dates of your reporting period. Ensure accuracy as this information is critical for tax calculation.

- Calculate your gross receipts and apportionment factor as necessary, following the instructions provided in the form.

- Complete the tax computation fields including prior payments, net tax due, penalty amounts, and interest if applicable.

- Declare that the information provided is accurate by signing in the appropriate section, ensuring that you include your daytime phone number and the date of signing.

- At the end of the form, you have the option to save your changes, download, print, or share your completed TX 05-139 report as needed.

Complete your TX 05-139 form online today to ensure compliance with Texas franchise tax requirements.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Extension to File Taxes in Texas for 2023 You must send payment for taxes in Texas for the fiscal year 2023 by May 15, 2024. The Extension Deadline is November 15, 2024 to file your Texas Individual Income tax return.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.