Loading

Get Chapter 25 - Payroll

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Chapter 25 - Payroll online

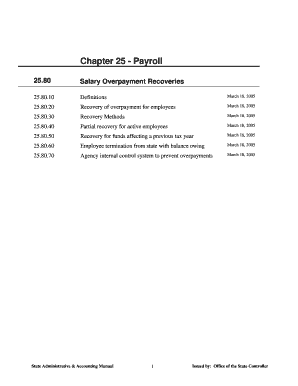

Filling out the Chapter 25 - Payroll document online is essential for managing salary overpayment recoveries effectively. This guide will provide you with clear, step-by-step instructions on how to complete each section of the form, ensuring a smooth process for both employers and employees.

Follow the steps to fill out the Chapter 25 - Payroll form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with the definitions section, where you will define terms like 'overpayment' and 'involuntary wage deduction' as they pertain to payroll management. Ensure you understand these concepts for accurate application in subsequent sections.

- In the recovery of overpayments to employees section, carefully read the guidelines. If an overpayment occurred due to employer error, determine if the employee knowingly accepted the overpayment. Depending on the percentage, follow appropriate recovery procedures that may require employee approval.

- For recovery methods, ensure you are aware of the steps to request the return of overpayment from the employee promptly. Document all communications and follow up if payment is not received within the stipulated timeline.

- In the partial recovery for active employees section, outline how to notify employees of the overpayment and make the necessary adjustments in the payroll system. Track the recovery process to ensure full compensation is returned over the designated pay periods.

- Address any recoveries of funds affecting a previous tax year by detailing the requirements for returning overpayment and requesting necessary corrections from the payroll unit. Maintain records for proper accounting adjustments.

- For employees who have terminated and have a balance owing, be sure to follow the guidelines for recovering overpayments. Prepare to document any written permissions required for deductions from final wages.

Start filling out your Chapter 25 - Payroll document online to ensure accurate payroll management and compliance.

Philippines Income Tax Rates In 2024 Individuals earning an annual taxable income of up to 250,000 PHP are exempt from taxes while those making more than 8 million PHP per year are charged a 15% – 30 % tax rate (Previously 20% – 32%).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.