Loading

Get Sc Uce-101-s 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC UCE-101-S online

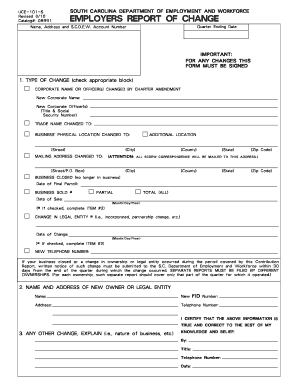

The SC UCE-101-S form is essential for reporting changes to employment and workforce information in South Carolina. This guide will provide you with step-by-step instructions on how to accurately complete this form online to ensure compliance and proper documentation.

Follow the steps to complete the SC UCE-101-S form online.

- Select the 'Get Form' button to access the SC UCE-101-S form and open it in your preferred online editor.

- Identify the first section, which pertains to the type of change. Check the appropriate box corresponding to the change you are reporting, such as corporate name changes or business physical location changes.

- If applicable, provide the new corporate name or the new corporate officer details, including their title and social security number, in the designated fields.

- Fill in the new trade name and business physical location information, ensuring to include complete and accurate street, city, county, state, and zip code details.

- If your mailing address has changed, enter the new mailing address where all correspondence from the South Carolina Department of Employment and Workforce will be sent.

- If applicable, specify if the business is closed or sold by checking the appropriate box, and provide the date of final payroll or date of sale.

- Complete section two if there is a name and address of a new owner or legal entity involved in the change. Provide the federal identification number (FID), the new owner's name, address, and telephone number.

- In section three, describe any additional changes that are relevant, such as changes in the nature of the business.

- Certify that the information provided in the form is accurate to the best of your knowledge by signing the form and entering your title, telephone number, and date.

- Once you have completed the form, save your changes. You may download or print the completed form for your records, and share it as necessary.

Complete the SC UCE-101-S form online today to ensure your business is accurately reported.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

In South Carolina, the unemployment tax rate can vary between employers but generally falls within a specific range set by the state. The maximum tax rate is determined annually, considering the state's financial needs and fund balance. If you’re new to calculating these taxes, utilizing resources such as SC UCE-101-S can provide clarity and guidance on what to expect.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.