Loading

Get Applicant Name: . An Act Relating To Annual Reports Concerning Certain Tax Incentive

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Applicant Name: . AN ACT Relating To Annual Reports Concerning Certain Tax Incentive online

Filling out the Applicant Name: . AN ACT Relating To Annual Reports Concerning Certain Tax Incentive form is essential for reporting on specific tax incentives. This guide will help you navigate the process clearly and effectively.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

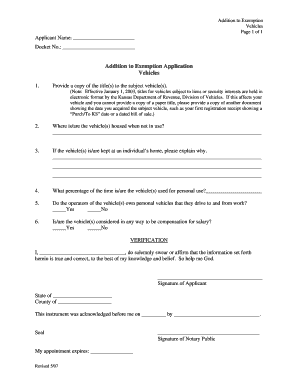

- In the section labeled 'Applicant Name:', input your full legal name. Ensure that the spelling is correct as it will be used for official documentation.

- Next, locate the 'Docket No.' field. Enter the docket number associated with your application, if applicable. This number helps in tracking and managing your report.

- For the vehicle section, provide a copy of the title of the vehicle(s) in question. If your title is held electronically, include a copy of a relevant document that confirms the vehicle acquisition, like a registration receipt or a bill of sale.

- Indicate where the vehicle(s) are housed when not in use by providing the address in the specified field.

- If the vehicle(s) are stored at someone's home, include an explanation in the designated area outlining the reason.

- State the percentage of time the vehicle(s) are used for personal activities in the provided space.

- Answer whether the operators of the vehicle(s) own personal vehicles for commuting by selecting 'Yes' or 'No'.

- Indicate if the vehicle(s) are considered compensation for salary by selecting 'Yes' or 'No'.

- Finally, the applicant must sign to verify that all the information is truthful and correct. You will also need to have this signature notarized, so ensure that you complete the section labeled 'Verification' as required.

- Once completed, you can save your changes, download, print, or share the form as needed.

Complete your documents online today for a smooth submission process.

Under the CTA, the following business entities (domestic or foreign) must file a BOI report with FinCEN (unless they qualify for an exemption): Limited liability companies (LLCs) Corporations. Other entities created by the filing of a document with a Secretary of State or similar office.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.