Loading

Get Inactive Provider Beneficiary Form - Ric - State Of Iowa - Ric Iowa

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Inactive Provider Beneficiary Form - RIC - State Of Iowa - Ric Iowa online

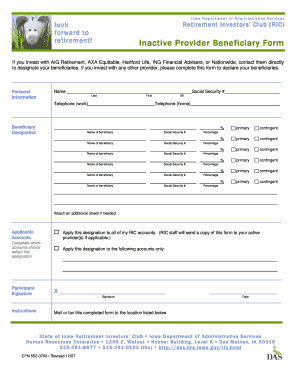

Filling out the Inactive Provider Beneficiary Form is essential for designating your beneficiaries when investing through RIC. This guide will walk you through each step required to complete the form accurately and efficiently online.

Follow the steps to complete the Inactive Provider Beneficiary Form.

- Click ‘Get Form’ button to access the Inactive Provider Beneficiary Form and open it in the designated editor.

- Begin by entering your personal information at the top of the form. Provide your first name, middle initial, last name, Social Security number, and both work and home telephone numbers.

- In the beneficiary designation section, list the names of your beneficiaries. For each beneficiary, provide their Social Security number and the percentage of your account you wish them to receive. Ensure that the total percentage for all beneficiaries equals 100%.

- Indicate whether each beneficiary is a primary or contingent beneficiary by selecting the appropriate option next to their names.

- If you have more beneficiaries than can be listed on the form, you may attach an additional sheet with the required information.

- Next, specify if you want to apply this designation to all your RIC accounts or just select accounts by marking the appropriate checkbox.

- After filling out all sections, you must sign and date the form at the bottom to validate your beneficiary designations.

- Finally, save your changes, and download or print the completed form. Be sure to mail or fax it to the designated location as indicated.

Complete your documents online today to ensure your beneficiary designations are up-to-date.

Unlike 401(k) plans, which require employees to wait until age 59 ½ before making qualified withdrawals, 457 plans allow withdrawals at whatever age the employee retires. And the IRS doesn't impose a 10% early withdrawal penalty on withdrawals made before age 59 ½ if you retire (or take a hardship distribution).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.