Loading

Get Must Be Submitted By December 1, 2010 - State Of Indiana - In

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MUST BE SUBMITTED BY DECEMBER 1, 2010 - State Of Indiana - In online

This guide provides clear, step-by-step instructions on how to effectively complete the MUST BE SUBMITTED BY DECEMBER 1, 2010 - State Of Indiana - In form online. It is designed to assist users in navigating through the form's components, ensuring a smooth submission experience.

Follow the steps to successfully complete the form online.

- Click the ‘Get Form’ button to access the document and begin the filling process.

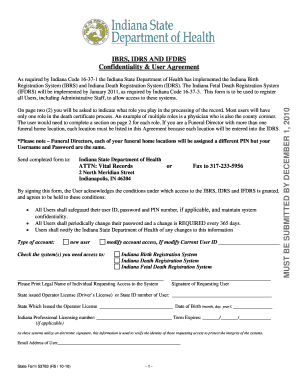

- On the first page, indicate your role in the processing of the record. Most users will only have one role, but if you have multiple roles (e.g., physician and county coroner), fill out the section as required for each role.

- If you are a Funeral Director with multiple locations, provide the details for each location in the specified sections to ensure they are included in the IDRS.

- Complete the required fields including the Legal Name of the individual requesting access, along with the State issued Operator License or State ID number and Date of Birth.

- Select the type of account by marking 'new user' or 'modify current user,' depending on your situation. Enter your Current User ID if you are modifying access.

- Select the systems you require access to by checking the appropriate boxes for the Indiana Birth Registration System, Indiana Death Registration System, and Indiana Fetal Death Registration System.

- For each facility location you provide, fill out the facility information, including the Facility/Location Name, Indiana License number, County, and contact details.

- Indicate the roles you will have in completing the records for each location. Check all relevant options under both Birth User Type and Death User Type.

- Once all sections are completed, review the form for accuracy. You can then save changes, download, print, or share the form as necessary. Ensure to submit it by the deadline.

Start the process now and complete your form online to meet the submission deadline.

Generally, the sale of food and food ingredients for human consumption is exempt from Indiana sales tax. Primarily, the exemption is limited to the sale of food and food ingredients commonly referred to as “grocery” food.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.