Loading

Get Ny Code 195(1) 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY Code 195(1) online

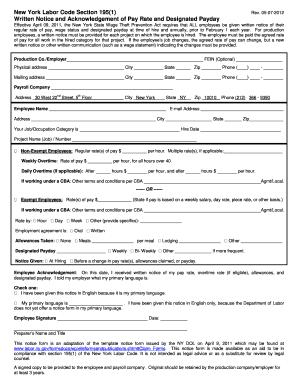

Filling out the NY Code 195(1) is an essential task for employers under the Wage Theft Prevention Act. This guide provides you with a clear and supportive approach to complete the form accurately and efficiently online.

Follow the steps to successfully complete the NY Code 195(1).

- Press the ‘Get Form’ button to access the NY Code 195(1) and open it in the designated online editor.

- Begin by filling in the employer's details. Include the production company's name and the Federal Employer Identification Number (FEIN).

- Next, provide the physical and mailing addresses of the employer. Ensure all fields for city, state, and zip code are completed accurately.

- Enter the payroll company's details, including their name, address, and contact phone number.

- Fill in the employee's information, including their name, email address, and address. Make sure to include city, state, and zip code.

- Indicate the employee's job or occupation category and the hire date.

- For non-exempt employees, provide their regular hourly rate of pay, including any multiple rates, overtime rates for both weekly and daily, and any applicable Collective Bargaining Agreement (CBA) terms.

- For exempt employees, indicate their pay rates and the basis it is calculated upon, like weekly salary or other methods.

- Designate the payday and indicate how notice was given regarding the pay rate, allowances, and payday frequency.

- Complete the employee acknowledgment section, ensuring the employee signs and dates the document appropriately.

Complete your NY Code 195(1) online to ensure compliance with labor regulations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The 4-hour rule in New York refers to a specific provision quite relevant in the realm of labor laws. This rule mandates that employers must provide employee breaks under particular circumstances based on worked hours. Understanding NY Code 195(1) can help clarify how these regulations apply to your situation, ensuring compliance and protection for workers.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.