Loading

Get Nc Substitute W-9 Form 2023-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NC Substitute W-9 Form online

The NC Substitute W-9 Form is a crucial document for individuals and organizations in North Carolina to provide taxpayer identification information. Completing this form accurately is essential for ensuring timely payments and compliance with tax regulations.

Follow the steps to fill out the NC Substitute W-9 Form online.

- Press the ‘Get Form’ button to obtain the NC Substitute W-9 Form and open it in your online document editor.

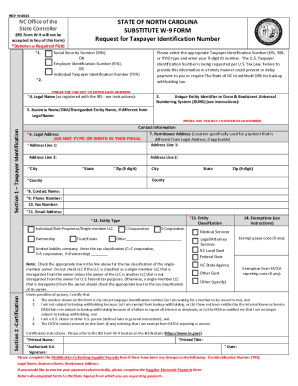

- Select the appropriate taxpayer identification type from the options provided: Employer Identification Number (EIN), Social Security Number (SSN), or Individual Taxpayer Identification Number (ITIN). Enter your 9-digit identification number in the designated field.

- If applicable, provide your Unique Entity Identifier or DUNS Number in the space given.

- Fill in your legal name as registered with the IRS in the designated field. Ensure that this name matches the identification documents.

- If your business name differs from your legal name, enter it in the Business Name/DBA/Disregarded Entity Name field.

- Complete your legal address by entering Address Line 1, City, State, and Zip Code in the respective fields.

- If your remittance address is different from your legal address, fill in the Remittance Address, including Address Line 1, City, State, and Zip Code.

- Provide your contact information, including your contact name, phone number, fax number (if applicable), and email address.

- Indicate your entity type by selecting the appropriate classification from the provided options.

- If you qualify for any exemptions, enter the exemption codes in the Exemptions section.

- Review the certification statements provided and ensure that you meet the conditions laid out before signing.

- Finally, input your printed name, title, authorized signature, and date to complete the form.

- Once you have filled out the form, save your changes, and download, print, or share the completed NC Substitute W-9 Form as necessary.

Start completing your documents online today!

When is a W9 Not Required? A W9 from vendors is not required when payments will be less than $600 in a calendar year, but it is a good idea to request a W9 from all vendors. Also a W9 is not required when payments are not associated with conducting a trade or business.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.