Loading

Get Or Saif G1023 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the OR SAIF G1023 online

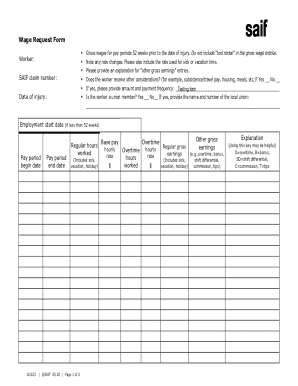

The OR SAIF G1023 form is essential for workers seeking wage-related information in relation to their claims. This guide will provide you with clear instructions to ensure successful completion of the form online.

Follow the steps to effectively complete the OR SAIF G1023 form.

- Click ‘Get Form’ button to obtain the OR SAIF G1023 form and open it in your preferred editor.

- Enter the worker's name and SAIF claim number in the designated fields at the top of the form. Ensure accuracy for effective communication regarding the claim.

- Fill in the date of injury, which is critical for processing the request. Confirm that this date aligns with the information in your claim documents.

- Provide gross wages for the 52 weeks prior to the date of injury, omitting any 'tool rental' amounts from your entries. This section helps to establish the income basis for your request.

- Document any rate changes and detail the rates used for sick or vacation time. This is important for evaluating your overall wage situation.

- Detail any 'other gross earnings' entries, and explain them in the provided spaces to clarify any additional income sources.

- Indicate whether the worker receives other considerations such as subsistence, travel pay, housing, or meals, by marking ‘yes’ or ‘no’. If applicable, specify the amount and frequency of these payments.

- If the worker is a union member, respond accordingly and provide the name and number of the local union. This ensures that all relevant affiliations are noted.

- Fill in the employment start date if the duration is less than 52 weeks, along with the pay period begin and end dates.

- Document the hours worked, including regular, sick, vacation, and holiday hours, in the appropriate sections.

- Complete the hourly rate for base pay and overtime, including overtime hours worked. Ensuring accuracy here is critical for payroll calculations.

- Provide information on regular gross earnings, other gross earnings, and any additional explanations for those earnings using the provided key.

- Have the preparer print their name and title in the relevant area, and ensure the form is signed by the worker.

- Finally, include the date of signing and a contact telephone number where the worker can be reached.

- Once all fields are completed, you can save any changes made, download a copy, print, or share the completed form as needed.

Complete the OR SAIF G1023 form online to ensure your wage requests are properly processed.

How to write a salary history letter Read your state and local laws. Before you begin to write a salary history letter, determine whether the employer is allowed to request this information at all. ... Read the job description. ... Choose a format. ... Use salary ranges.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.