Loading

Get Ftb 3567 Installment Agreement Request. Ftb 3567, Installment Agreement Request

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FTB 3567 Installment Agreement Request online

The FTB 3567 Installment Agreement Request form is crucial for those who need to manage their tax liabilities through manageable installment payments. This guide will provide detailed, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete your installment agreement request.

- Press the ‘Get Form’ button to acquire the form and open it for editing.

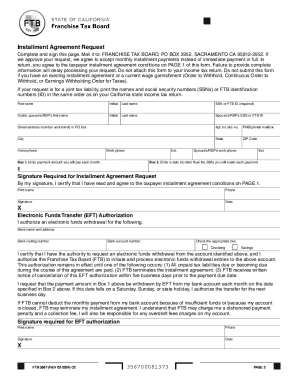

- Begin by providing your personal information in the designated fields, including your first name, last name, and Social Security number or Franchise Tax Board identification number.

- If your request is for a joint tax liability, fill in the corresponding fields for your partner’s information, including their first name, last name, and Social Security number or Franchise Tax Board identification number.

- Enter your street address, apartment number if applicable, city, state, and ZIP code to ensure accurate correspondence.

- Provide the home and work phone numbers for efficient communication.

- In Box 1, specify the amount you intend to pay each month towards your tax liability.

- In Box 2, choose a date by which you will make each payment, ensuring it is no later than the 28th of the month.

- Sign the form to certify that you have read and agree to the taxpayer installment agreement conditions outlined in the form.

- For electronic funds transfer (EFT) authorization, fill in your bank name, address, routing number, and account number. Indicate whether the account is checking or savings.

- Once you have completed all sections of the form, review your entries for accuracy, then save your changes, and either download or print the completed document.

Complete your tax documents online for a more streamlined process.

Why did I receive this letter? Our records show that you have an outstanding balance. Additional interest will accrue if the tax and/or fee is not paid in full. Details of the balance due are shown on your letter.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.