Loading

Get Form 2587 ( Rev. 5-2005). Application For Special Enrollment Examination

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Form 2587 (Rev. 5-2005). Application For Special Enrollment Examination online

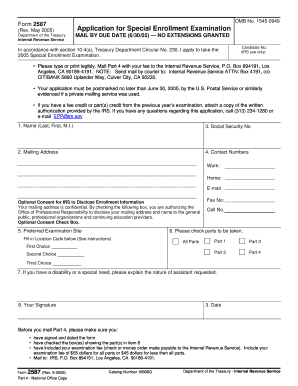

Filling out the Form 2587 is an essential step for those wishing to take the Special Enrollment Examination. This guide provides a clear and concise walkthrough of the form's components and helps ensure accurate completion to avoid delays in processing.

Follow the steps to fill out the Form 2587 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your name in item 1 using the format Last, First, M.I. Ensure it matches your identification documents.

- Input your mailing address in item 2. This address will be used for correspondence regarding the examination credential letter and results.

- Provide your social security number in item 3. This information is crucial for identification purposes.

- Fill in your contact numbers in item 4. Include your work, home, and email addresses to ensure the IRS can reach you easily.

- Choose your preferred examination site in item 5. Refer to the location codes provided in the form and list your first, second, and third choices.

- Indicate which parts of the examination you plan to take in item 6 by checking the appropriate boxes. You must select all parts unless you have previously passed some.

- If you have a disability or require special assistance, explain your needs in item 7.

- Sign and date the form in item 8. This signifies that all information provided is accurate, and you agree to the terms.

- Finally, review your form to ensure all sections are completed correctly. Save changes, download, print, or share the form as needed before mailing it to the IRS at the address provided.

Complete your Form 2587 online now to take the next steps towards your examination.

How hard is the EA exam? The IRS Enrolled Agent exam pass rate fluctuates from 70% to 74%. This is a high pass rate compared to other professional accounting exams, like the CPA, which has an average pass rate of 45-50%. The IRS sets a scaled passing score at 105 out of the available 130 points.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.