Loading

Get 1997 Nj-1065 Partnership Return - State Of New Jersey - State Nj

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1997 NJ-1065 Partnership Return - State of New Jersey online

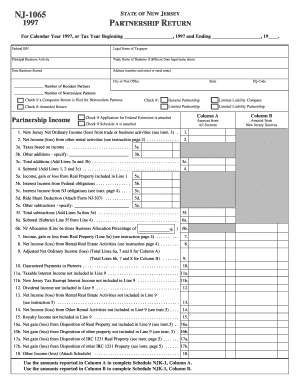

Filing the 1997 NJ-1065 Partnership Return in New Jersey is an essential step for partnerships to report income and ensure compliance with state tax regulations. This guide provides a clear and detailed approach to completing the form online, tailored to assist all users, regardless of their experience level.

Follow the steps to accurately complete the online NJ-1065 Partnership Return.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the calendar year or the specific tax year for which you are filing in the designated fields.

- Fill in the Federal EIN, legal name of the taxpayer, and principal business activity.

- Complete the trade name of the business if it is different from the legal name provided.

- Provide the date the business started and the full address, including number and street, city, state, and zip code.

- Indicate the number of resident and nonresident partners, and check the box if a composite return is being filed for nonresident partners.

- Select the type of partnership by checking the appropriate box for general partnership, limited partnership, or limited liability company.

- If applicable, check the box for an amended return and include any application for federal extensions or attachment of Schedule A.

- Complete the income sections by reporting New Jersey net ordinary income (loss) and net income (loss) from other activities as per the instructions.

- Enter any additions or subtractions necessary for the calculation of adjusted net ordinary income, including taxes based on income and interest income.

- Fill out the partners directory with the details of each partner, including the percentage owned and their respective identification numbers.

- Sign the return as a general partner or designated partner, and include the preparer’s information if applicable.

- Once the form is completed, options to save changes, download, print, or share the document will be available.

Complete your NJ-1065 Partnership Return online today and ensure compliance with New Jersey tax requirements.

New Jersey's Corporate Business Tax (CBT) Surcharge is a 2.5% tax on every dollar of profits above $1 million and is now set to expire on December 31, 2023.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.