Loading

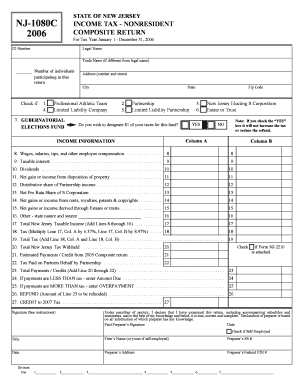

Get Nj1080-c 2006. State Of New Jersey Income Tax - Nonresident Composite Return - State Nj

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NJ1080-C 2006. State Of New Jersey Income Tax - Nonresident Composite Return - State Nj online

This guide provides comprehensive instructions for completing the NJ1080-C 2006, the Nonresident Composite Return for the State of New Jersey. Whether you are a new user or have prior experience, this step-by-step approach will help you navigate the form with confidence.

Follow the steps to efficiently complete and file your nonresident composite return.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the ID number and the legal name as prompted on the top section of the form. If you have a different trade name, include it in the designated space.

- Specify the number of individuals participating in this return by filling in the corresponding field.

- Provide your address, including the number and street, city, state, and zip code in the appropriate fields.

- Indicate if you are part of specific categories by checking the appropriate boxes such as Professional Athletic Team or Limited Liability Company.

- Decide whether to contribute $1 to the gubernatorial elections fund by checking 'YES' or 'NO'.

- Proceed to input income information across various categories, including wages, taxable interest, dividends, and more. Fill out columns A and B as applicable, ensuring accuracy.

- Calculate total New Jersey taxable income by adding the amounts from lines 8 through 16 and enter the result on Line 17.

- Determine your tax by multiplying the total taxable income on Line 17 by the applicable rates and record this on Line 18.

- Sum up your total tax and any credits. Fill in Lines 19 through 27 as instructed based on your payments or overpayments.

- Complete the signature section, certifying the accuracy of your return under penalty of perjury.

- Finally, review the completed form, save changes, and prepare to download, print, or share it as needed.

Complete your NJ1080-C 2006 form online today to ensure accurate filing of your nonresident composite return.

The application uses the information in this section to complete Form NJ-1080C, Income Tax Nonresident Composite Return, and Form NJ-1080E, Election to Participate in a Composite Return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.