Loading

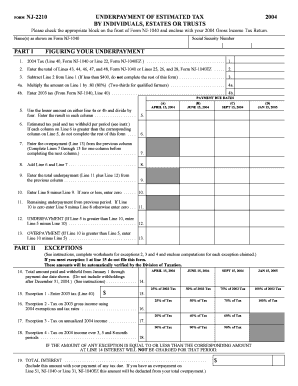

Get Form Nj-2210 Underpayment Of Estimated Tax By Individuals, Estates Or Trusts 2004 Please Check The

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FORM NJ-2210 UNDERPAYMENT OF ESTIMATED TAX BY INDIVIDUALS, ESTATES OR TRUSTS 2004 online

This guide provides a clear and user-friendly approach to filling out Form NJ-2210, which addresses the underpayment of estimated tax requirements for individuals, estates, or trusts. By following these steps, you will accurately complete the form and ensure compliance with New Jersey tax obligations.

Follow the steps to complete Form NJ-2210 efficiently.

- Press the ‘Get Form’ button to access the form, making it available in your chosen editing format.

- Enter your name(s) as shown on Form NJ-1040 at the top of the form. Ensure that your details are accurate to avoid any issues.

- Provide your Social Security Number in the designated field to link the form to your tax records.

- In Part I, begin with Line 1 by entering your 2004 tax amount from Line 40 of Form NJ-1040 or Line 22 of Form NJ-1040EZ.

- Next, Line 2 requires you to enter the total of Lines 43, 44, 46, 47, and 48 from Form NJ-1040 or Lines 25, 26, and 28 from Form NJ-1040EZ.

- For Line 3, subtract Line 2 from Line 1. If this amount is less than $400, you do not need to complete the rest of the form.

- If Line 3 is $400 or more, proceed to Line 4a. Multiply the amount on Line 1 by 80% (or two-thirds for qualified farmers) and enter the result.

- For Line 4b, input the 2003 tax amount from Form NJ-1040, Line 40.

- For line 5, divide the lesser amount from Line 4a or 4b by four and enter this amount in each column.

- In Line 6, record the estimated tax paid and tax withheld for each period as instructed. This will help identify if your payments are sufficient.

- Proceed to Lines 7 through 13 to calculate the total underpayment by following the instructions for each line carefully.

- Finally, review your completed form to ensure all information is entered correctly. Once verified, you can save changes, download, print, or share the form as needed.

Complete your Form NJ-2210 online to ensure you're compliant with tax regulations and avoid potential interest on underpayments.

Form 2210 - Schedule AI - Annualized Income Installment Method. In order to complete Schedule AI in the TaxAct program, you first need to complete the Underpayment Penalty section of the Q&A, which transfers automatically to Part II of Form 2210 Underpayment of Estimated Tax by Individuals, Estates, and Trusts.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.