Loading

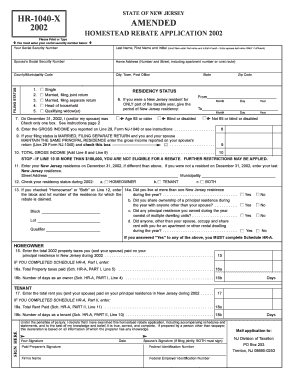

Get Hr-1040-x 2002 State Of New Jersey Amended Homestead Rebate Application 2002 Please Print Or Type

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the HR-1040-X 2002 State of New Jersey Amended Homestead Rebate Application online

This guide provides a comprehensive overview of the HR-1040-X 2002 State of New Jersey Amended Homestead Rebate Application. Whether you are a first-time user or need assistance with amending previously submitted information, follow these clear instructions to successfully complete the form online.

Follow the steps to accurately complete your HR-1040-X form online.

- Press the ‘Get Form’ button to download the HR-1040-X 2002 State of New Jersey Amended Homestead Rebate Application, and open it in your preferred editor.

- Begin by entering your social security number in the designated field. If filing jointly, include your spouse's social security number as well.

- Fill in your last name, first name, and initial in the appropriate fields. Ensure that the information is accurate and typed clearly.

- Provide your complete home address, ensuring to include the street number, street name, apartment number (if applicable), county/municipality code, city, town, and zip code.

- Select your filing status by checking only one of the boxes available, including options for single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

- Indicate your residency status for 2002 by providing the exact period of your New Jersey residency if applicable.

- Complete the section for age or disability status; check the box if you or your spouse are aged 65 or older, blind, or disabled.

- Enter the gross income as reported on Line 29 of your NJ-1040 form. Make sure it reflects your total income for the year.

- If married and filing separately, check the box and report your spouse's gross income from their NJ-1040 form.

- Sum your income and your spouse's income (if applicable) on Line 10. If totalling over $100,000, you will not qualify for the rebate, and further sections can be skipped.

- If applicable, provide the address of your New Jersey residence on December 31, 2002, and check your homeowner or tenant status in the relevant boxes.

- Complete the necessary sections for homeowners or tenants as applicable, entering any requested information such as property taxes or rent paid.

- Carefully review all the information provided, correcting any typographical errors or inaccuracies.

- Sign and date the application to affirm the accuracy of your submission. If filing jointly, have your spouse also sign the form.

- Once all information is accurately filled, save your changes, and consider downloading, printing, or sharing the application based on your needs.

Complete your HR-1040-X form online today to ensure your homestead rebate application is processed efficiently.

You can also request a check tracer for your New Jersey Income Tax refund check for the current year by calling the Division's Automated Refund Inquiry System at 1-800-323-4400.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.