Loading

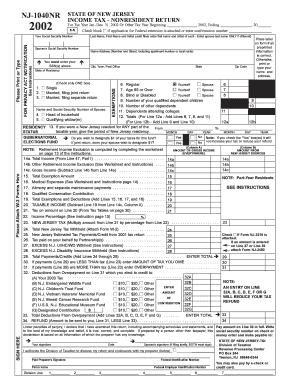

Get Form Nj 1040-nr. State Of Nj Income Tax - Nonresident Return For The Yax Year Jan. - Dec. 31, 2002

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form NJ 1040-NR. State Of NJ Income Tax - Nonresident Return For The Year Jan. - Dec. 31, 2002 online

Filling out the Form NJ 1040-NR is essential for nonresidents who earned income in New Jersey during the tax year. This guide provides a clear, step-by-step process to help users navigate the form online with ease and confidence.

Follow the steps to accurately complete your NJ 1040-NR form online.

- Press the ‘Get Form’ button to obtain the form and access it in your preferred document editor.

- In the section for personal information, fill in your last name, first name, and middle initial. For joint filers, include the first name and initial of your spouse next to their last name, if different.

- Enter your spouse's social security number, if applicable, and ensure that you input your own social security number in the designated area.

- Provide your home address, including street number and name, city or town, state, and zip code, accurately.

- Indicate your state of residency by selecting the appropriate box in the residency section.

- Complete the exemptions section by filling in details about yourself and your spouse, including age and any disabilities, as applicable.

- List any qualified dependents you claim, as well as their social security numbers, ensuring that all information is correct.

- If applicable, provide information on any New Jersey residency period during the taxable year.

- Move to the income section, carefully detailing your total income from various sources, including wages, interest, and any other income types.

- Complete the exemptions and deductions section according to the instructions, mentioning any medical expenses and other relevant deductions.

- Calculate your taxable income and use the tax tables provided in the instructions to find your tax amount.

- Provide any New Jersey tax withheld and other payments or credits. Add these amounts to calculate your total payments.

- Review the Overpayment section to select any contributions to charitable funds or to credit future tax payments, if applicable.

- Lastly, sign and date the form, ensuring that if you are filing jointly, both you and your spouse sign the return.

- Once everything is complete, save your changes, and download the completed form. You can then print or share it as needed.

Begin your online NJ 1040-NR filing today to ensure your tax documents are submitted accurately and on time.

Sprintax was created specifically for nonresident professionals, international students, scholars, teachers and researchers in the US on F, J, M and Q visas. Our software makes it easy for all nonresidents to prepare their US taxes online and stay compliant with IRS tax rules.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.