Loading

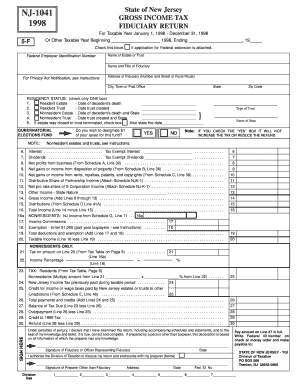

Get 104198.qxd. Form Nj-1041 (1998) Fiduciary Return - State Nj

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 104198.qxd. Form NJ-1041 (1998) Fiduciary Return - State Nj online

Filling out the NJ-1041 form is an essential step for fiduciaries managing an estate or trust in New Jersey. This guide will walk you through the process of completing the form online in a clear and supportive manner.

Follow the steps to successfully complete your NJ-1041 form.

- Click 'Get Form' button to obtain the NJ-1041 form and open it in your preferred online editor.

- In the first section, provide the required federal employer identification number and check the box if an application for federal extension is attached. Fill in the name of the estate or trust, as well as the name and title of the fiduciary managing the estate or trust.

- Complete the fiduciary's address, including number and street, city or town, state, and zip code.

- Select the residency status by checking only one box. Indicate if it is a resident estate or trust, or a nonresident estate or trust, and provide the necessary dates as prompted.

- Report income on lines designated for interest, dividends, net profits from business, and other income categories. Each line will guide you to enter corresponding income figures. If applicable, attach the necessary schedules for additional details.

- Once all income is recorded, calculate the total gross income and follow the instructions to determine deductions and exemptions.

- Calculate the taxable income and utilize the tax tables provided to determine the tax owed based on your filing status.

- Fill out the payment and credit sections to display any prior tax payments and potential refunds.

- Sign and date the form in the designated areas, ensuring all information is accurate and complete. If applicable, obtain the signature of any preparer.

- Finally, review the completed form to ensure all sections are accurately filled out, then proceed to save changes, download, print, or share the form as needed.

Begin your filing process online today and ensure compliance with New Jersey fiduciary tax requirements.

A grantor trust must file a Form NJ-1041. If the grantor trust income is reportable by or taxable to the grantor for federal income tax purposes, it also is taxable to the grantor, and not the trust, for New Jersey Income Tax purposes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.