Loading

Get Form Nj-1041 (1997) - State Of New Jersey - State Nj

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form NJ-1041 (1997) - State Of New Jersey - State Nj online

Filing Form NJ-1041 is essential for reporting the income of estates and trusts in the State of New Jersey. This guide provides step-by-step instructions to help users navigate the online filing process effectively.

Follow the steps to complete Form NJ-1041 online.

- Press the ‘Get Form’ button to retrieve the form and open it in your online editor.

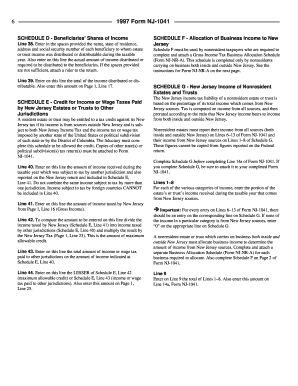

- Begin by filling out Schedule D, where you will enter the names, states of residence, addresses, and social security numbers of each beneficiary to whom estate or trust income was distributed during the taxable year. Also, indicate the actual amount of income distributed or required to be distributed.

- For Schedule E, determine if the estate or trust has income subject to both New Jersey tax and taxes imposed by other jurisdictions. Enter the total amount of income received during the taxable year that was subject to tax by another jurisdiction in Line 40, and the corresponding New Jersey taxed income for Line 41.

- Calculate the maximum allowable credit by dividing the income taxed by New Jersey (Line 41) by the income taxed by other jurisdictions (Line 40) and then multiplying that result by the New Jersey tax amount (Page 1, Line 23). Enter this value on Line 42.

- Input the total amount of income or wage tax paid to other jurisdictions on Line 43 based on the income reported in Line 40, and then enter the lesser of the amounts from Line 42 or Line 43 on Line 44.

- If applicable, complete Schedule F to allocate business income to New Jersey, ensuring to provide the necessary Gross Income Tax Business Allocation Schedule (Form NJ-NR-A) if you are a nonresident taxpayer operating both within and outside New Jersey.

- Complete Schedule G by reporting New Jersey income for nonresident estates or trusts. This schedule should reflect the portion of income from New Jersey sources, ensuring that every entry corresponds to entries made on Lines 6-13 of Form NJ-1041.

- Finally, review all your entries for accuracy. Save your changes, and proceed to download and print the form for your records, or share it as needed.

Complete your document filings online with confidence and efficiency!

ing to the Resident, Part-Year, and Nonresident filing instruction web-pages, you must file a return if: Your filing status is Single or Married Filing Separate AND your gross income was at least $10,000, OR. What are New Jersey's Filing Requirements? - TaxSlayer Support taxslayer.com https://support.taxslayer.com › en-us › articles › 360015... taxslayer.com https://support.taxslayer.com › en-us › articles › 360015...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.