Loading

Get Ks K-cns 100 2006

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KS K-CNS 100 online

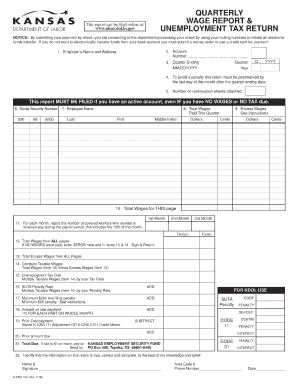

The KS K-CNS 100 is an important document that individuals may need to complete for various purposes. This guide provides clear and supportive instructions to help you navigate the online filling process seamlessly.

Follow the steps to fill out the KS K-CNS 100 online with ease.

- Click the ‘Get Form’ button to access the KS K-CNS 100 and open it in your preferred editing platform.

- Begin by filling in your personal information in the designated fields, which typically include your full name, contact details, and address. Ensure that all information is accurate to avoid any delays.

- Next, focus on the sections that require details about your situation or the purpose for which you are completing the form. Provide comprehensive and truthful information to support your submission.

- Review each section carefully. If there are any checkboxes or options, be sure to select the ones that apply to your circumstance.

- Once you have filled in all required fields, take a moment to review all the information you provided for accuracy and completeness.

- Finally, save your changes. You may have options to download your completed form, print it out, or share it directly online, depending on the specific platform you are using.

Complete your documents online today for a simplified process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The weekly amount for Kansas unemployment benefits is determined by your previous earnings, with maximums typically reaching around $500 per week. This amount can significantly assist those facing job loss during recovery. Additionally, the KS K-CNS 100 resources can help you navigate applying for benefits and understanding the specific numbers that apply to your situation.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.