Loading

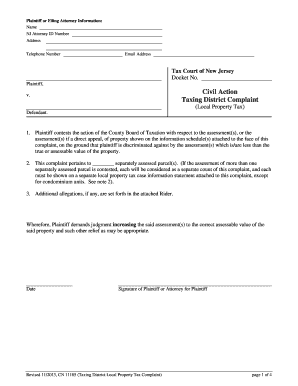

Get Complaint Form - Taxing District Increasing Assessment. Complaint Form - Taxing District Increasing

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Complaint Form - Taxing District Increasing Assessment online

This guide provides clear instructions on how to accurately complete the Complaint Form - Taxing District Increasing Assessment online. Whether you are a seasoned property owner or a first-time filer, this user-friendly resource will help you navigate each section of the form with confidence.

Follow the steps to complete the form effectively.

- Click ‘Get Form’ button to access the Complaint Form - Taxing District Increasing Assessment and open it in the online editor.

- Begin by filling in the plaintiff or filing attorney information at the top of the form. Include your name, New Jersey Attorney ID number (if applicable), address, telephone number, and email address.

- Indicate the Tax Court of New Jersey docket number in the designated area. This ensures your complaint is connected to the correct case.

- Detail the civil action by writing the name of the defendant, who is typically the local property tax authority. This establishes the context of your complaint.

- In the section that follows, state your reasons for contesting the assessment. Clearly articulate your claim, including points about potential discrimination or inaccuracies in the assessment value.

- Document how many separately assessed parcels are included in your complaint. Each will be treated as a separate count, so ensure that each parcel is listed correctly.

- If there are any additional allegations to include, do so in the attached rider. This can provide further context to your complaint.

- Sign and date the form at the bottom to confirm that all the information provided is accurate. If you are an attorney filing on behalf of the plaintiff, identify yourself accordingly.

- Prepare the proof of service document. Make sure to check the appropriate method of service selected for each recipient, including the defendant, clerk, assessor, and administrator.

- Ensure that all required documents are enclosed, including the local property tax case information statement, proof of service, copies of relevant judgments, and the correct filing fee.

- You can then save changes, download, print, or share the completed form as per your requirements.

Start filling out the Complaint Form - Taxing District Increasing Assessment online to address your property tax concerns.

You can just simply file the assessment complaint appeal at the Will Board of Review (BOR). There office is in the Will County Office Building located at 302 North Chicago Street in Joliet, Illinois. They will notify and give the assessor a copy of the appeal.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.