Loading

Get Voluntary Contribution Report - New Jersey Department Of Labor

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Voluntary Contribution Report - New Jersey Department Of Labor online

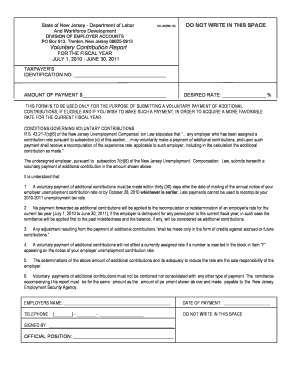

This guide provides clear and comprehensive instructions on how to complete the Voluntary Contribution Report required by the New Jersey Department of Labor. Following these steps will help ensure that you accurately submit your voluntary payment of additional contributions online, which may lead to a more favorable tax rate for your business.

Follow the steps to successfully complete the report online.

- Press the ‘Get Form’ button to access the Voluntary Contribution Report and open it in the online editor.

- In the 'Taxpayer's Identification No.' field, enter your unique identification number that corresponds to your business.

- Next, specify the 'Amount of Payment' you wish to make by entering the dollar amount in the designated space.

- Indicate your 'Desired Rate' by writing the percentage you are aiming to achieve in the current fiscal year.

- Provide your 'Employer’s Name' as it appears in official documents.

- Fill in the 'Date of Payment' to reflect the date you are submitting this report.

- Include your contact 'Telephone' number for any follow-up communications.

- Make sure to sign the form in the 'Signed By' section and include your official position in your organization.

- After completing all fields, review your entries for accuracy, then save changes to the form.

- You can now download, print, or share the completed form as needed.

Complete your Voluntary Contribution Report online today to enhance your unemployment tax rate efficiently.

Who Pays For SUI? Employers are responsible for state unemployment insurance tax for their own employees. The amount of SUI the company pays depends on the SUI rates they're eligible for. Almost all companies are required by law to pay this tax, but there are some rare exemptions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.