Get Hi Pts Enrollment Form 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the HI PTS Enrollment Form online

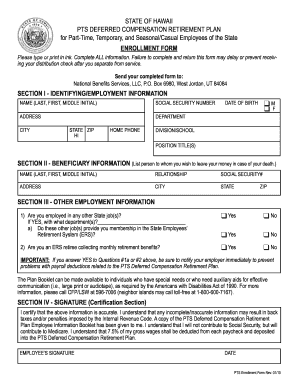

Completing the HI PTS Enrollment Form is essential for part-time, temporary, and seasonal/casual employees of the State of Hawaii to enroll in the Deferred Compensation Retirement Plan. This guide provides step-by-step instructions to help you fill out the form accurately and efficiently.

Follow the steps to successfully complete the HI PTS Enrollment Form

- Press the ‘Get Form’ button to obtain the form and open it for editing.

- In Section I, provide your identifying and employment information. Fill in your name, social security number, address, department, city, state, zip code, home phone number, and date of birth. Please mark your gender as either male or female.

- Continue in Section I by entering your division or school and your position title(s). Ensure all fields are filled completely.

- Move to Section II to provide beneficiary information. List the name, relationship, social security number, address, city, state, and zip code of the person to whom you wish to leave your funds in the event of your death.

- In Section III, answer questions regarding any other State job(s) you hold. If applicable, specify the departments and indicate whether these jobs provide membership in the State Employees’ Retirement System.

- Next, indicate if you are an ERS retiree receiving monthly retirement benefits. If you answered 'yes' to the previous questions, ensure to notify your employer to avoid payroll issues.

- In Section IV, read the certification statement carefully. By signing the form, you affirm that the information provided is accurate and that you understand the implications regarding Social Security and Medicare deductions.

- Finally, sign and date the form. Review all filled sections to verify completeness before submission.

Complete your HI PTS Enrollment Form online today to ensure your participation in the retirement plan.

Get form

The PTS deferred compensation retirement plan is a tailored program aimed at employees looking to secure their financial future by deferring some of their earnings. Participants in this plan can benefit from potential tax advantages and investment growth. For those interested in enrolling, the HI PTS Enrollment Form provides an easy-to-follow process to get started. This plan helps you build the retirement savings you need for a comfortable lifestyle.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.