Loading

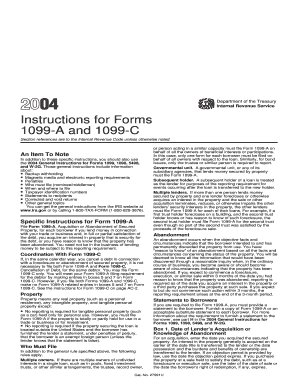

Get 2004 Instruction 1099 A & C. Instructions For Forms 1099 A And C - Irs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2004 Instruction 1099 A & C. Instructions for Forms 1099 A and C - IRS online

Filling out Form 1099-A and Form 1099-C can seem challenging, but this guide will walk you through each step clearly and concisely. Whether you are a lender required to report acquisition of secured property or the cancellation of a debt, understanding these forms is essential for compliance.

Follow the steps to accurately fill out the 2004 Instruction 1099 A & C forms.

- Press the ‘Get Form’ button to obtain the necessary form and open it in your document editor.

- Review the general instructions before completing the form, as these contain critical information on filing requirements and deadlines.

- For Form 1099-A, enter the acquisition date in Box 1. This is the date you acquired secured property or knew of its abandonment.

- In Box 2, input the balance of principal outstanding on the debt at the time of acquisition or abandonment.

- Box 4 requires the fair market value of the property; for foreclosure sales, this is typically the gross foreclosure bid.

- In Box 5, indicate if the borrower was personally liable for the repayment of the debt by marking the appropriate box.

- Provide a description of the property in Box 6, including details like the address for real property or type and model for personal property.

- Alternatively, for Form 1099-C, enter the date of cancellation in Box 1 and the total amount of the canceled debt in Box 2.

- Fill in the interest amount, if included, in Box 3, and a description of the debt type in Box 5.

- Finally, review all details for accuracy, then save your changes, and choose to download, print, or share your completed form.

Start completing your 2004 Form 1099 A & C online today for accurate reporting.

If you receive Form 1099-A, you will need to report it on Schedule D of your tax return that year. Form 1099-A can help you determine if you have any capital gain or loss from the foreclosure of your property. Capital gains from foreclosure are treated the same as capital gains from a traditional sale.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.