Loading

Get Tap Elevated - Improveirs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TAP Elevated - Improveirs online

This guide provides a clear and structured approach to completing the TAP Elevated - Improveirs form online. With detailed instructions for each section and field, users with varying levels of experience can effectively navigate the process.

Follow the steps to successfully complete the TAP Elevated - Improveirs.

- Press the ‘Get Form’ button to access the electronic version of the TAP Elevated - Improveirs form and open it in your preferred digital editor.

- Begin by filling in the basic information fields such as your name, contact details, and the date. Make sure to double-check for accuracy to prevent delays.

- Proceed to the section for tax-related details. This may include specifics about income, deductions, or credits you are claiming. Refer to the instructions provided in the form for guidance on each item.

- In the subsequent fields, provide any necessary documentation or additional notes as required by the form. Be meticulous to ensure all supporting information is clearly indicated.

- Review your entries for any errors or omissions. It's advisable to compare your filled form against the original instructions to ensure completeness.

- Once satisfied with your completion, select options to save changes, download a copy for your records, or print the form directly. If necessary, you can share the completed form as required.

Get started on completing your TAP Elevated - Improveirs form online today!

Related links form

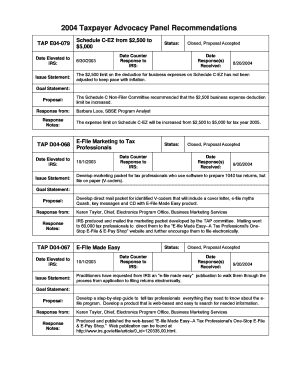

The IRS claims that nearly half of all requests for help from the Taxpayer Advocate's Service are resolved satisfactorily to the taxpayer, in under five days. Complex problems take ten to 30 days—still good by normal IRS standards! The Taxpayer Advocate Service was formerly called the Problems Resolution Program.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.