Loading

Get Co Pera 8/147 2012-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CO PERA 8/147 online

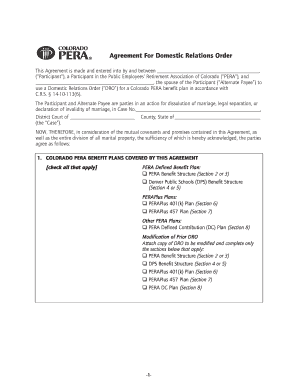

Filling out the CO PERA 8/147 form is an essential step in establishing a Domestic Relations Order related to Colorado PERA benefits. This guide will provide you with a clear, step-by-step approach to ensure that you complete the form accurately and efficiently.

Follow the steps to successfully fill out the CO PERA 8/147 online.

- Press the ‘Get Form’ button to access the CO PERA 8/147 document and open it in your chosen editing tool.

- Begin by filling out the participant and alternate payee information at the top of the form. Ensure both parties' names and relevant details are correctly entered to avoid any future complications.

- Identify the applicable PERA benefit plans covered by this agreement. Check all options that apply, including PERA Defined Benefit Plan, PERAPlus Plans, or other PERA Plans.

- Complete the sections pertaining to whether the participant is a retiree under the PERA benefit structure or the DPS benefit structure. Be mindful to check the correct box and fill in the required percentage or fixed dollar amounts as specified.

- If you are dividing a defined benefit account, provide any necessary details under the corresponding sections, including methods of division, lump-sum dollar amounts, or monthly payment options.

- Review and complete any additional sections relevant to PERAPlus Plans if applicable, ensuring that all necessary percentage and valuation date information is accurately filled out.

- In the 'Agreement and Undertaking of the Parties' section, be sure to read through and acknowledge the outlined agreements by both parties.

- Once completed, save any changes made to the form. You may then download, print, or share the document as needed for your records or further processing.

Start completing your CO PERA 8/147 form online today to ensure a smooth process for your Domestic Relations Order.

The primary tax document for CO PERA 8/147 is your W-2 form, which summarizes your annual contributions and deductions. This document provides essential information needed for your tax return each year. Properly managing and understanding this tax document helps ensure that you report your PERA contributions accurately and take advantage of available tax benefits.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.