Loading

Get Ar Ar4ec(tx)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AR AR4EC(TX) online

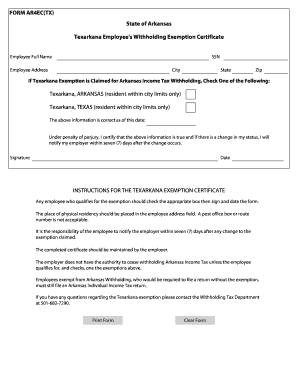

The AR AR4EC(TX) form is essential for employees in Texarkana to claim their withholding exemption. This guide will walk you through each section of the form, providing clear instructions to ensure accurate completion.

Follow the steps to successfully complete the AR AR4EC(TX) form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling in your full name in the 'Employee Full Name' section, ensuring it matches your identification documents.

- Enter your Social Security Number (SSN) in the appropriate field, as this number is essential for tax processing.

- Provide your complete address in the 'Employee Address' section. Please use a physical residential address, as a post office box or route number is not acceptable.

- Fill in your city, state, and zip code, making sure all information is accurate and up to date.

- If you are claiming the Texarkana exemption for Arkansas income tax withholding, check the box for the appropriate residency: either Texarkana, Arkansas (for residents within city limits only) or Texarkana, Texas (for residents within city limits only).

- Review all the information entered to ensure correctness as of the date you complete the form.

- Upon completion, save your changes. You can then download, print, or share the form based on your needs.

Complete your AR AR4EC(TX) form online today to ensure proper withholding exemptions.

A form AR TX usually refers to the state's tax form necessary for filing income or other taxes. The requirements for this form can change, depending on regulations in both the Texas and Arkansas jurisdictions. Familiarizing yourself with forms like the AR AR4EC(TX) will ensure you stay compliant and avoid potential issues.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.