Loading

Get Wy Appendix 1 Worksheet

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WY Appendix 1 Worksheet online

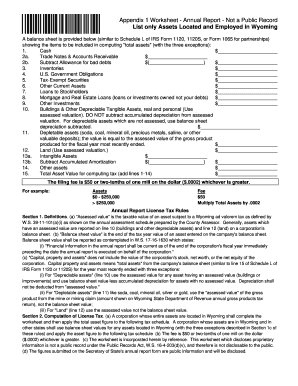

The WY Appendix 1 Worksheet is an essential document for corporations to report their total assets located and employed in Wyoming. This guide provides a clear, step-by-step process to assist users in completing the form online effectively.

Follow the steps to fill out the WY Appendix 1 Worksheet online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by noting the cash balance. Enter the total cash amount in the provided field under item 1.

- For items 2a (Trade notes & accounts receivable), enter the total amount. Then, in item 2b, enter the allowance for bad debts as a negative value to subtract it from the receivables.

- Input the value of inventories under item 3. Ensure this figure reflects the most accurate assessment of current stock.

- Under item 4, report any U.S. government obligations held. This includes bonds or securities.

- For item 5, enter any tax-exempt securities you hold as current assets.

- List other current assets in item 6. Be thorough and ensure all relevant assets are accounted for.

- In item 7, report any loans to stockholders, ensuring you are reflecting the current outstanding amount.

- Item 8 requires you to state the mortgage and real estate loans owned, as long as they are not counted as your debts.

- For item 9, report any other investments you hold, categorizing them appropriately.

- In item 10, list the assessed value of depreciable tangible assets, without taking depreciation into account unless specified.

- Item 11 is for depletable assets—enter the assessed value of products produced in the last fiscal year.

- For item 12, report the assessed value of land owned.

- In item 13a, document the amount of intangible assets. Dedicate item 13b to subtract the accumulated amortization from the intangible assets.

- Under item 14, report any other assets that do not fit in the previous categories.

- Calculate the total assets by summing the values from items 1 through 14 and input this result in item 15 for the total asset value used for computing tax.

- Review all entered values for accuracy. Once confirmed, save changes, and consider options to download, print, or share the completed form.

Complete your WY Appendix 1 Worksheet online today to ensure accurate reporting.

Annual LLC Fees Wyoming's LLC is required to pay an annual fee of $60 to the Secretary of State beginning the second year. There is again a $2 convenience fee for paying online. The annual report is technically calculated as the lesser of $60 or $60 for every $250k in assets in Wyoming.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.