Loading

Get Il Il-5754 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL IL-5754 online

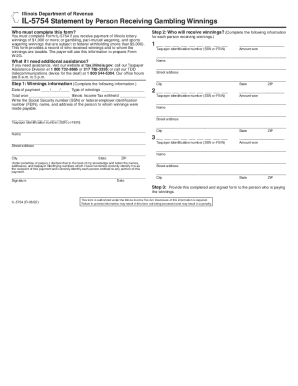

The IL IL-5754 form is essential for documenting gambling winnings that are subject to federal withholding. This guide provides a step-by-step approach to help you fill out the form accurately and efficiently online.

Follow the steps to complete the IL IL-5754 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In section one, provide the information regarding the winnings. Fill in the city and date of payment, type of winnings, total won, and the amount of Illinois income tax withheld. Ensure you write the taxpayer identification number (SSN or FEIN) along with the name and address of the person to whom the winnings were made payable.

- In section two, list each person who will receive winnings. Fill out the taxpayer identification number, amount won, name, street address, city, state, and ZIP for each individual. Be thorough to ensure accuracy.

- In section three, before submitting the form, sign your name and provide the date, city, and any additional required information confirming that you are the recipient of the payment and that the details provided are correct.

- Once you have completed all sections, review the form for any errors or omissions. You can then save changes, download, print, or share the form as needed.

Complete the IL IL-5754 form online to ensure your gambling winnings are properly documented.

Purpose of form. You must complete Form 5754 if you receive gambling winnings either for someone else or as a member of a group of two or more people sharing the winnings, such as by sharing the same winning ticket.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.