Loading

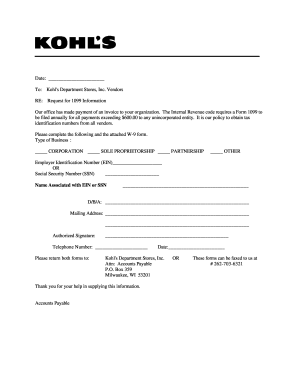

Get Wi Kohls Request For 1099 Info

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WI Kohls Request for 1099 Info online

Filling out the WI Kohls Request for 1099 Info is a straightforward process that helps ensure compliance with tax regulations. This guide provides step-by-step instructions for successfully completing the form online.

Follow the steps to complete the Wisconsin Kohls Request for 1099 Info form.

- Click the ‘Get Form’ button to access the document and open it in your online editor.

- Begin by selecting your type of business. Indicate your status by checking the appropriate box: Corporation, Sole Proprietorship, Partnership, or Other.

- Next, provide your Employer Identification Number (EIN) or Social Security Number (SSN) in the designated field.

- Enter the name associated with the EIN or SSN in the corresponding space provided.

- Fill in the 'Doing Business As' (D/B/A) name if applicable, using the provided lines.

- Input your complete mailing address accurately in the specified fields to ensure proper correspondence.

- Please add an authorized signature in the section indicated to validate your submission.

- Provide a contact telephone number where you can be reached for any follow-up inquiries.

- Once all information is accurately filled out, save your changes. You may download the completed form, print it for records, or share it as needed.

Complete your documentation online to ensure compliance and streamlined processing.

For a 1099 job, you will generally fill out Schedule C, which reports income or loss from your business or profession. This is essential for self-employed individuals or freelancers. Services from US Legal can guide you through your WI Kohls Request for 1099 Info efficiently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.