Loading

Get Co Sales And Use Tax Return - City Of Northglenn 2017-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CO Sales And Use Tax Return - City Of Northglenn online

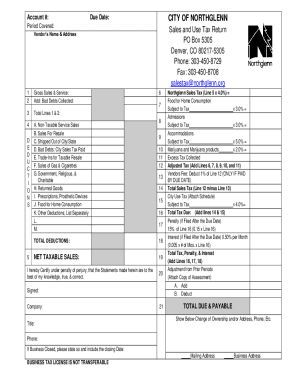

Filling out the CO Sales And Use Tax Return for the City Of Northglenn is an essential task for businesses that engage in taxable sales and services. This guide provides a clear step-by-step approach to accurately complete the form online.

Follow the steps to successfully complete your tax return.

- Press the ‘Get Form’ button to access the CO Sales And Use Tax Return form online.

- Enter your account number, due date, and the period covered at the top of the form.

- Input the vendor's name and address accurately in the designated fields.

- For gross sales and service, complete the designated field with the total amount from your sales records.

- Add any bad debts collected in the respective field.

- Calculate the total by summing the amounts in Lines 1 and 2, and input this in the appropriate field.

- Complete the deductions section by specifying the amounts for each applicable category A through K, including non-taxable sales and other deductions relevant to your business.

- Sum up the total deductions and enter this figure in the designated field.

- Calculate your net taxable sales by subtracting total deductions from the total gross sales, and enter this number.

- Proceed to compute the sales tax based on the provided percentages for different product categories.

- Deduct the vendor's fee if applicable, based on the rules mentioned in the form, and enter the amount.

- Calculate the total tax due by adding city sales tax and use tax amounts.

- If filing after the due date, calculate penalties and interest, entering these amounts accordingly.

- Calculate the total amount due and payable and ensure all fields are accurate.

- At the end, certify and sign the document, providing your title and company name.

- Review all entered information for accuracy before saving your changes. You can now download, print, or share the completed form as needed.

Complete your CO Sales And Use Tax Return online quickly and efficiently!

The total combined sales tax rate in Thornton is 8.5%, and is comprised of the following taxes: City of Thornton 3.75% State of Colorado 2.90% RTD/CD 1.10%

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.