Loading

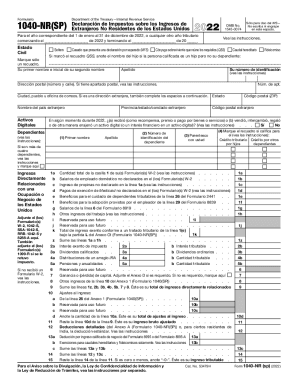

Get Irs 1040-nr (sp) 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040-NR (SP) online

The IRS 1040-NR (SP) form is essential for non-resident foreigners to report their income and taxes in the United States. This guide will provide comprehensive, step-by-step instructions on how to fill out this form online efficiently.

Follow the steps to accurately complete the IRS 1040-NR (SP) online.

- Click ‘Get Form’ button to obtain the form and open it in the editor. This will allow you to begin filling out the IRS 1040-NR (SP) online.

- Select your filing status. Mark only one of the boxes for your civil status: single, married filing separately, qualifying surviving spouse, or estate.

- Enter your personal information. Provide your first name, middle initial, last name, and identification number. Ensure this information is accurate to avoid processing delays.

- Fill out your address. It is critical to complete your postal address correctly, including apartment number, city, and postal code. If applicable, also include foreign address details.

- Report dependents if applicable. Record any dependents by providing their names, identification numbers, and relationship to you, marking the appropriate box for tax credits if qualified.

- Input your income details. Report all income from U.S. employment, including wages, tips, and other compensations. Use the relevant lines on the form for calculations.

- Calculate your adjusted gross income. Follow the instructions to subtract any adjustments from your total income, as this will define your taxable income.

- Determine your deductions. You may choose either itemized deductions (using Schedule A) or the standard deduction if applicable, according to your filing situation.

- Calculate your total tax liability. Fill in tax amounts from applicable schedules and compute any credits you may claim, tallying up for a total tax amount.

- Review your payments and determine if you owe taxes or are entitled to a refund. List any payments made and calculate the difference between tax owed and payments.

- Complete the signature section. Ensure to sign and date the form, entering your contact number and any preparer information if a tax professional assisted you.

- Once completed, save changes to your form, download a copy for your records, print it if needed, or share it as a required submission.

Begin your online filing process for the IRS 1040-NR (SP) today to ensure compliance and timely submission.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.