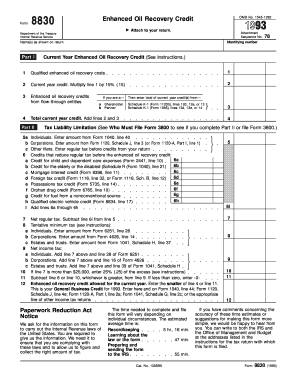

Get 1993 Form 8830. Enhanced Oil Recovery Credit - Irs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign 1993 Form 8830. Enhanced Oil Recovery Credit - Irs online

How to fill out and sign 1993 Form 8830. Enhanced Oil Recovery Credit - Irs online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Getting a legal professional, creating a scheduled appointment and going to the office for a personal conference makes doing a 1993 Form 8830. Enhanced Oil Recovery Credit - Irs from start to finish tiring. US Legal Forms lets you quickly produce legally binding documents according to pre-built browser-based templates.

Perform your docs within a few minutes using our simple step-by-step guideline:

- Find the 1993 Form 8830. Enhanced Oil Recovery Credit - Irs you want.

- Open it up using the cloud-based editor and start adjusting.

- Complete the empty fields; engaged parties names, places of residence and numbers etc.

- Customize the blanks with unique fillable areas.

- Add the particular date and place your e-signature.

- Click Done following double-checking all the data.

- Download the ready-made record to your gadget or print it as a hard copy.

Easily generate a 1993 Form 8830. Enhanced Oil Recovery Credit - Irs without having to involve professionals. There are already over 3 million customers making the most of our unique catalogue of legal documents. Join us today and get access to the #1 library of browser-based blanks. Try it yourself!

How to edit 1993 Form 8830. Enhanced Oil Recovery Credit - Irs: customize forms online

Pick a rock-solid file editing solution you can rely on. Revise, complete, and sign 1993 Form 8830. Enhanced Oil Recovery Credit - Irs securely online.

Very often, modifying documents, like 1993 Form 8830. Enhanced Oil Recovery Credit - Irs, can be a challenge, especially if you got them online or via email but don’t have access to specialized software. Of course, you can use some workarounds to get around it, but you risk getting a document that won't meet the submission requirements. Using a printer and scanner isn’t a way out either because it's time- and resource-consuming.

We provide a simpler and more efficient way of modifying files. A comprehensive catalog of document templates that are easy to edit and certify, and then make fillable for other individuals. Our platform extends way beyond a collection of templates. One of the best parts of using our option is that you can revise 1993 Form 8830. Enhanced Oil Recovery Credit - Irs directly on our website.

Since it's a web-based option, it saves you from having to get any application. Additionally, not all company rules allow you to install it on your corporate computer. Here's how you can effortlessly and securely complete your forms with our solution.

- Click the Get Form > you’ll be instantly taken to our editor.

- As soon as opened, you can kick off the customization process.

- Choose checkmark or circle, line, arrow and cross and other options to annotate your form.

- Pick the date field to add a particular date to your template.

- Add text boxes, images and notes and more to complement the content.

- Use the fillable fields option on the right to add fillable {fields.

- Choose Sign from the top toolbar to create and add your legally-binding signature.

- Hit DONE and save, print, and share or get the end {file.

Forget about paper and other ineffective methods for executing your 1993 Form 8830. Enhanced Oil Recovery Credit - Irs or other forms. Use our tool instead that combines one of the richest libraries of ready-to-customize templates and a powerful file editing option. It's easy and secure, and can save you lots of time! Don’t take our word for it, give it a try yourself!

A taxpayer may claim a credit for up to 15 percent of its qualified enhanced oil recovery costs attributable to a qualified domestic project for increasing the production of crude oil or for production of Alaskan natural gas ( Code Sec. 43). The credit is reported on Form 8830.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.