Loading

Get 2001 Form 8829

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2001 Form 8829 online

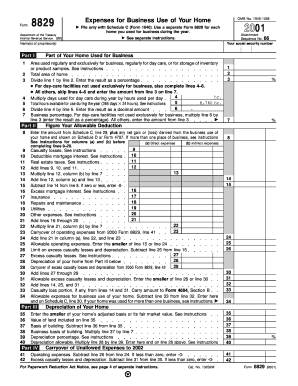

Filling out the 2001 Form 8829 is essential for claiming the home office deduction. This guide provides clear, step-by-step instructions to help users complete the form accurately and confidently online.

Follow the steps to fill out the 2001 Form 8829 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the name(s) of the proprietor(s) at the top of the form. This identifies the person or persons who qualify for the deduction.

- In Part I, identify the part of your home used for business by entering the area used regularly and exclusively for business, including for day care or storage purposes, along with the total area of your home.

- Calculate the business percentage by dividing the area used for business by the total area of the home. If applicable, complete the additional lines for day-care facilities.

- Proceed to enter the amounts from Schedule C, line 29 and any net gain or loss derived from your business use of the home, if applicable.

- Fill out Part II where you will detail the expenses for business use of your home, including direct and indirect expenses.

- In Part III, figure your allowable deduction based on the calculations you've made in previous sections. Stay within the guidelines necessary for depreciation and casualty losses.

- Finally, review your entries to ensure accuracy. You can then choose to save changes, download, print, or share the completed form.

Start completing your documents online today to maximize your home office deduction!

Highlights of the simplified option: Standard deduction of $5 per square foot of home used for business (maximum 300 square feet). Allowable home-related itemized deductions claimed in full on Schedule A. (For example: Mortgage interest, real estate taxes).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.